4 min read

Meet the TurboTeam: Goran Maksimovic

And then you realize that the people are your source that you’re learning from. And the people keep you in company and...

With such a competitive rental market to contend with, it can be difficult for applicants with bad credit to find housing. Sometimes a poor credit score is due to difficult circumstances outside of your control, so it can be frustrating when this is the reason you’re denied a rental. However, landlords must run background checks to keep themselves safe and make sure they protect their properties.

If you’re worried, bad credit history doesn’t mean the end of the road. Follow along below to learn more about this process and what you can do to pass an apartment credit check.

Though it may seem like overkill considering all the other documents required in a rental application, the credit check is actually one of the most important parts of a tenant’s background information. Credit checks are a standard piece of almost every rental application in the U.S. Maintaining a property is very expensive, and finding new tenants is a stressful and time-consuming process.

By doing thorough background research upfront, landlords ensure that they find responsible, financially stable tenants who will be able to pay rent on time each month. Otherwise, landlords and tenants might find themselves in the middle of eviction proceedings, which is painful for everyone involved!

Most landlords partner with one of the three major U.S. credit bureaus: TransUnion, Experian, or Equifax. These background checks will actually reveal much more about a prospective tenant than just their credit score; the goal is to discover any suspicious financial activity in the applicant’s background. Rental credit checks will allow landlords to view the following tenant information:

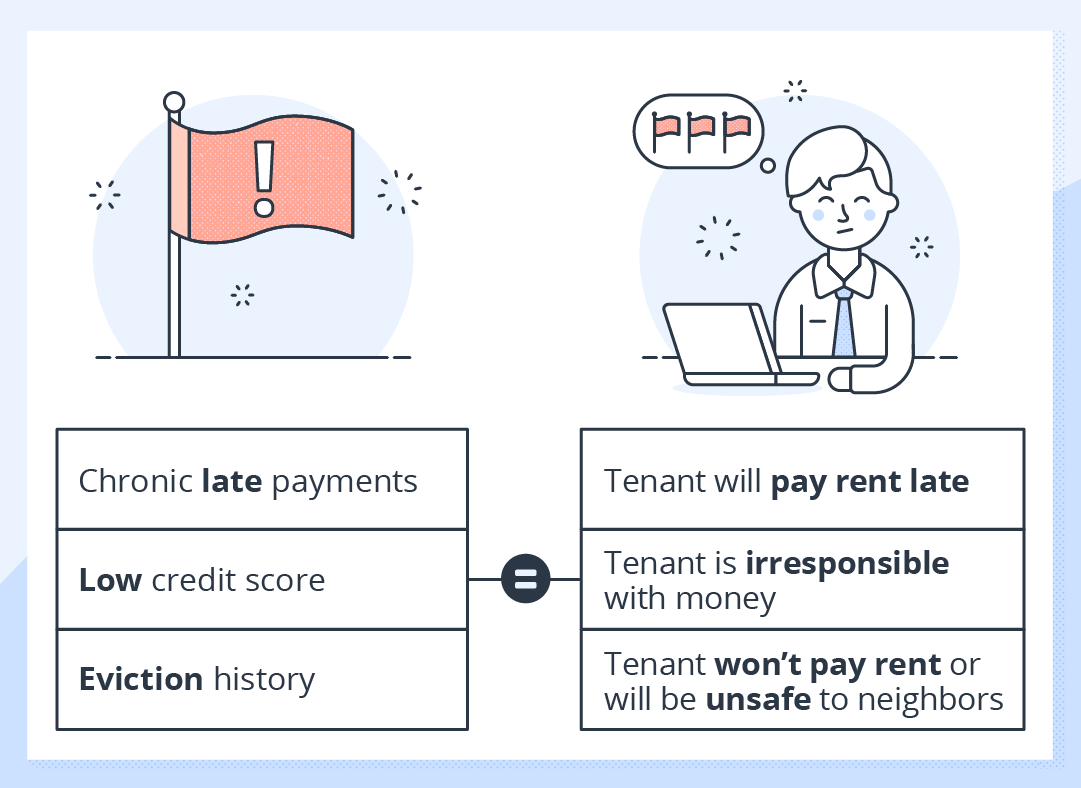

When analyzing this information, landlords scan for a number of red flags that could indicate the potential tenant wouldn’t be able to pay rent regularly or would be an unsafe addition to the community. These red flags include:

Learn more about this process with our guide to rental credit checks.

Pro Tip:

Most rental application credit checks are soft inquiries, meaning they won’t negatively impact the applicant’s credit score. Hard inquiries are used when opening lines of credit, such as a mortgage or other loans, and too many of this inquiry type will hurt the borrower.

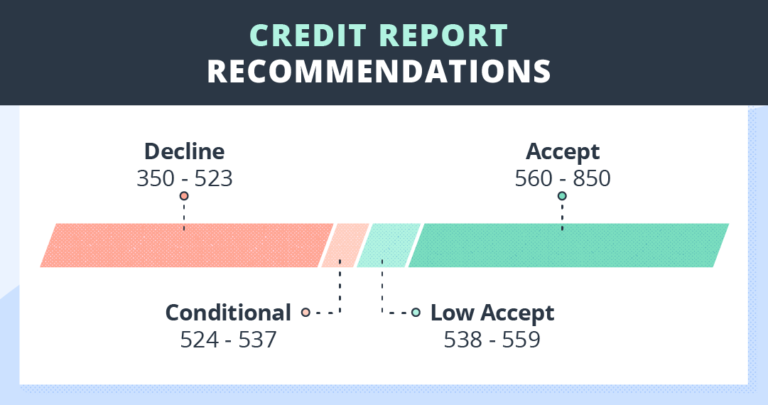

The minimum credit score needed to rent an apartment varies from location to location. Wealthier, more competitive areas will require a higher minimum score, as will new or luxury buildings. However, a good rule of thumb is that most landlords look for a credit score of at least 600. Anything under 600 is considered bad credit, but don’t worry – there are many ways to get around bad credit.

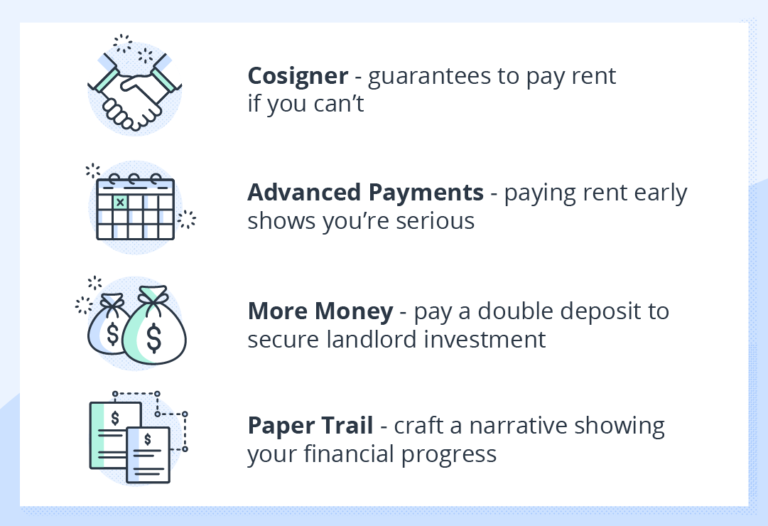

Just because you have a low credit score doesn’t mean you’re completely out of luck when it comes to renting a nice place. There are steps you can take to highlight your assets on your rental application. It’s all about showing the landlord that you would be a responsible and respectful tenant, and therefore a good investment for them.

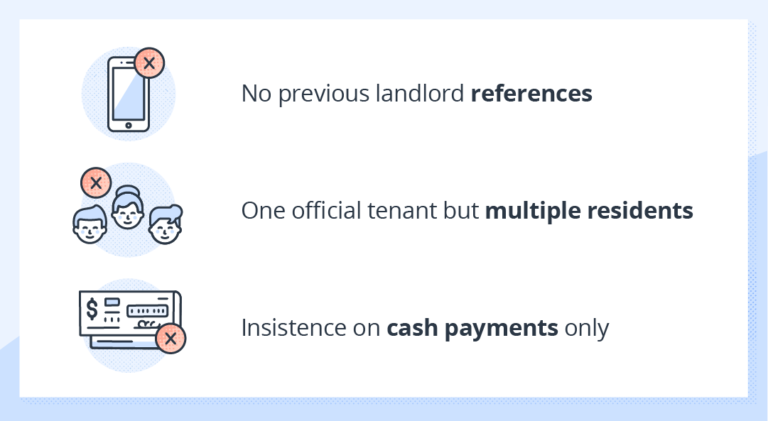

Though the rental credit check is meant to protect landlords, there are ways applicants try to get around this process. Landlords, here are a few red flags to watch out for, and tenants, here are a few moves you definitely shouldn’t try if you’re trying to be taken seriously!

Below are the answers to a few of the most commonly-asked questions when it comes to passing an apartment credit check.

Though this is below the recommended minimum of a 600 credit score, you can get an apartment with a 500 credit score. You may not be able to rent the apartment of your dreams until your credit improves, but you can find a good home to rent by highlighting your other application assets. This includes showing the landlord steady payment and employment histories, along with utilizing the help of a cosigner on the lease.

Again, you will need to prove to your landlord that you would be a solid investment for their property, even with a sub-par credit score. You can do this by highlighting the work you’ve been doing to reduce your debt through detailed documentation, along with offering to pay a larger security deposit.

Having an eviction history is one of the trickiest red flags to work around because it will make other landlords believe you are a bad renter. In this case, the more information you can provide the better.

Explain the situation to your landlord in an application cover letter, highlighting improvements you have made to your financial situation and steps you are taking to live more responsibly. Again, you will probably not be able to rent the apartment of your dreams, but a reasonable landlord will be understanding if you can make a good case for yourself.

In most cases, it should take two to three days for you to hear back about your application. During this time, landlords are pulling the data from your credit check and analyzing it for any issues, along with reading through the rest of your application materials. In high-turnover markets in major metropolitan areas, the application turnaround time can happen in just a day. If you feel your application is taking a long time to be reviewed, you should feel free to contact your agent or the landlord directly.

Unfortunately, there’s no surefire way to raise your credit score in a matter of weeks. This is one issue that takes time and dedication to see results. Make sure you are practicing “financial hygiene” by keeping up on all monthly bills. Avoid spending on credit cards, and consider increasing your credit card limit so that your utilization rate goes down.

The best way to raise your score is to request a credit report from one of the three major credit bureaus (TransUnion, Equifax, and Experian) and do a deep dive. Clean up any outstanding accounts so that your record is positive. Remember, you get one free credit report per year by law!

We hope this guide helped you learn everything you wanted to know about how to pass a rental credit check. If you need additional information about the tenant screening process, sign up for TurboTenant now.

4 min read

And then you realize that the people are your source that you’re learning from. And the people keep you in company and...

5 min read

We have this really good integration. We make them feel like they are part of the company....but it’s like we also make...

4 min read

Well, I guess the thing that pops into my mind right now is you have a lot of freedom to do things...

Join the 700,000+ independent landlords who rely on TurboTenant to create welcoming rental experiences.

No tricks or trials to worry about. So what’s the harm? Try it today!

Comprehensive Tenant Screening Reports

In less than 5 minutes, request a credit check, criminal background check, and eviction report to quickly find your perfect tenant.