14 min read

IRS Rules for Rental Property: Landlord Tax Guide for 2025

Staying compliant with IRS rules for rental property is a non-negotiable piece of the landlord puzzle. As we all know, Uncle Sam expects full transparency from...

When you decide to rent out your first property, the immediate goal becomes filling the vacancy with tenants. In order to list and market your property, you will first need to determine the rent price. Choosing a proper rent price will be important for running a profitable rental business as well as for attracting renters.

Below we will provide an overview of how to price your rental, including factors that affect price, how to add value to your listing price, and signs that you’ve priced your home wrong.

Once you’ve taken the proper steps to become a landlord, it’s time to evaluate your properties and decide which houses are prime for renting. There are a variety of reasons to rent your house:

Renting your property is a big decision, it’s important that you’re truly ready — use the questions below to get an idea of where you’re at and how you feel:

If your answers were trending towards “no,” it might be a sign that you have more prep work to do before you should rent out your home. If you mostly answered “yes,” you’re probably ready to price your home, get it listed, and take on the challenges and responsibilities of being a landlord.

There are two overarching factors that come into play when pricing your home property: the external factors (surrounding market) and internal factors (your property’s features). It’s crucial to understand that you want to find the right price, not the highest price.

Many people just have profit on their minds and don’t consider the fact that setting the right price will attract a larger pool of candidates and usually produce a more qualified tenant to rent the property.

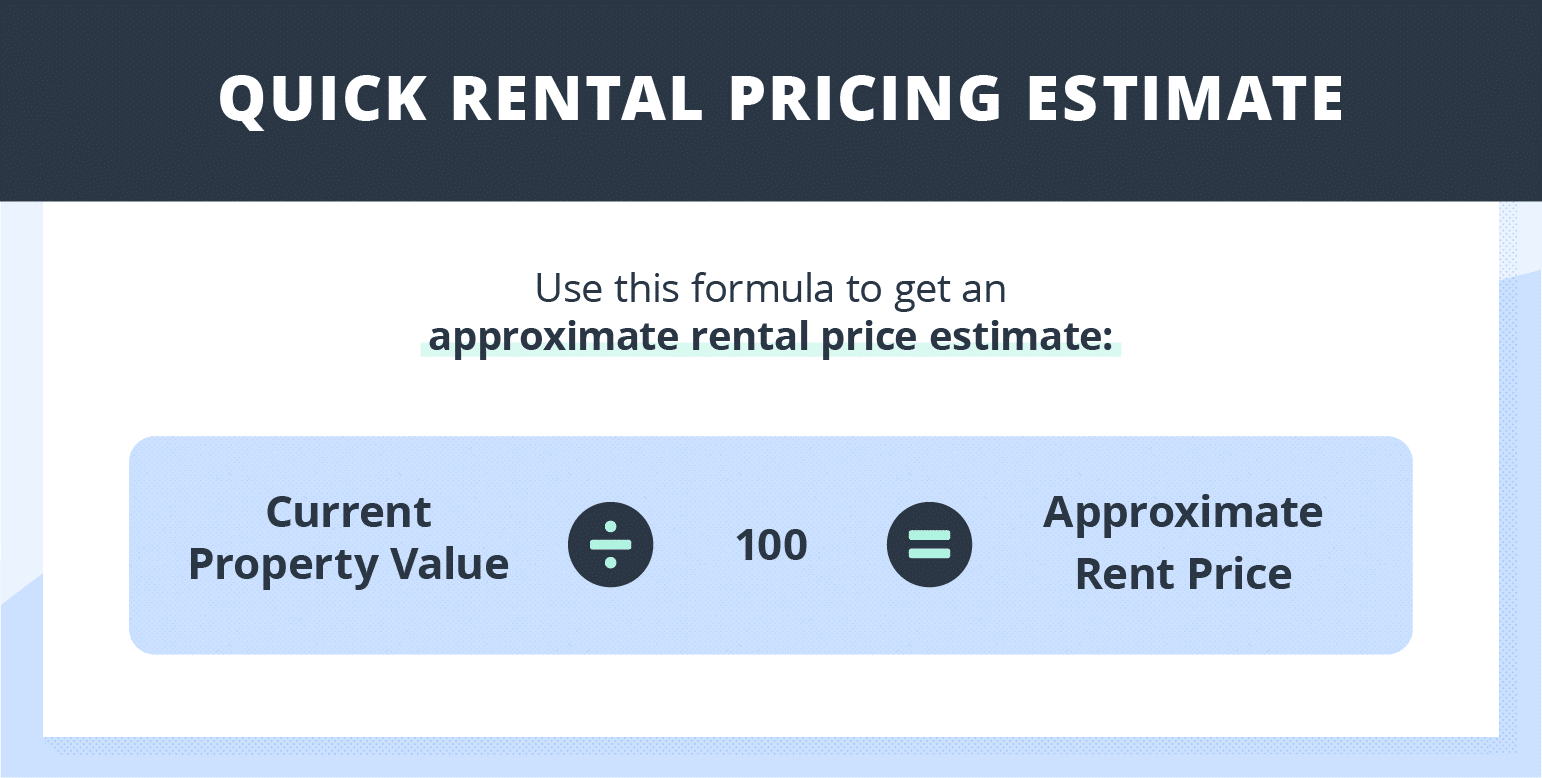

One Percent Rule

A good rule of thumb to get you started is to use the “one percent rule,” this states that your rental price should be approximately 1 percent (specifically from 0.8 percent to 1.1 percent) of your property’s current value. While this is a well-known method for rent pricing, it is not always accurate to the market your home is located in and shouldn’t be used alone.

There are many other factors that come into play when pricing your rent. Learn about those internal and external factors below.

It’s crucial to know your market when pricing your rental home. There are so many factors that come into play when pricing your rental which vary depending on your region — from sunny Floridian rental properties to rainy rentals in Washington there are different trends and features renters are looking for.

Perusing online listings in your area is the first step to get an idea of where your listing price sweet spot is. Keep an eye out for how long the listing has been posted; if there are properties that have been up for over a month (depending on your area) that could be an indicator that those prices are too high. The sites below are a great way to gauge the market in your area.

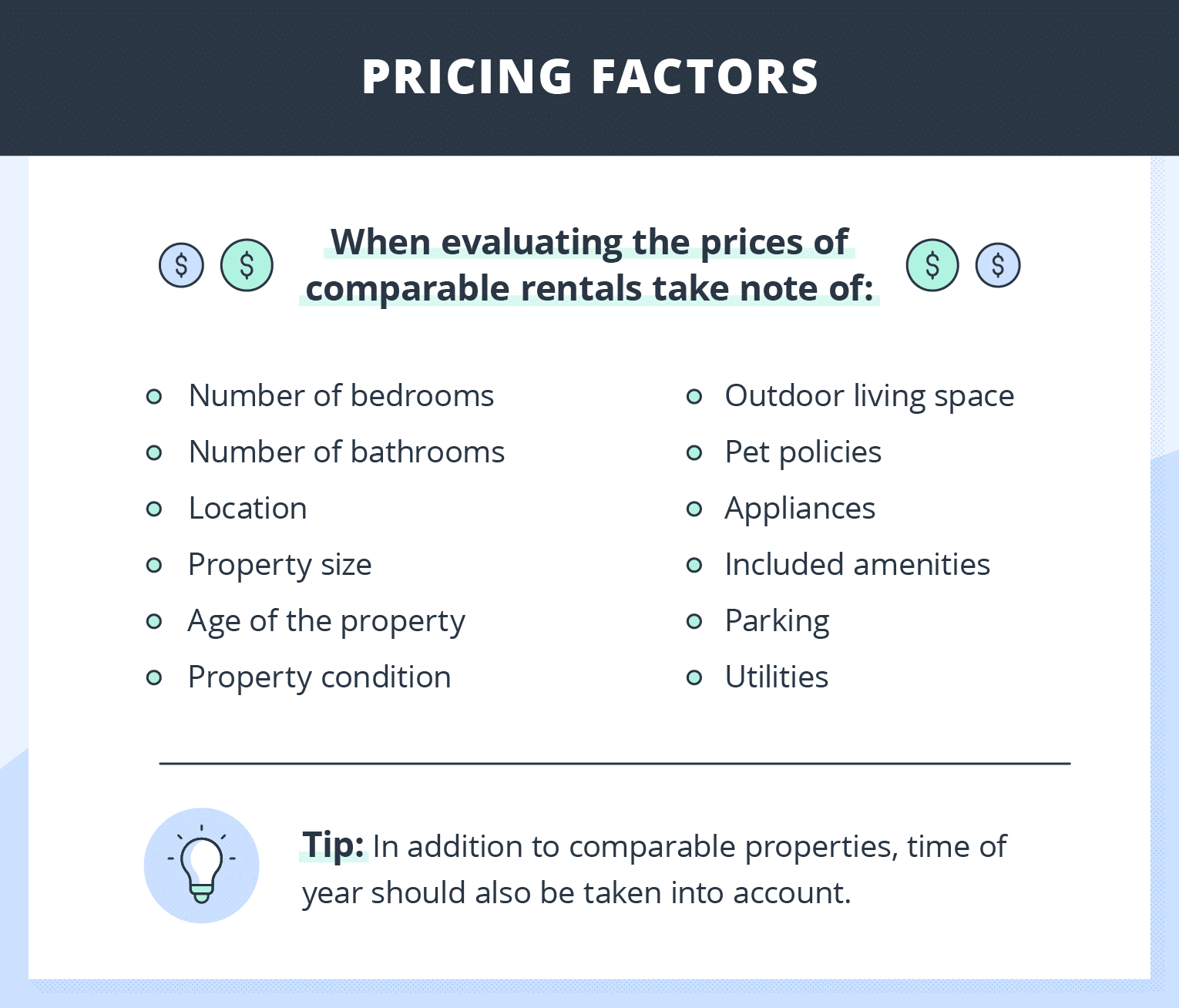

When you are comparing rent prices, take note of a few different factors.

As you take note of the prices of other properties in the area, search for properties that are as similar as possible to yours. While it may be hard to find a property with the exact specifications of yours, you can at least find enough properties with similarities to make an educated pricing decision.

It is also important to understand the seasonality of renting and the demand for your area when you put your property on the market. If you are in a high demand area, your pricing might be able to land a little higher. If, however, you are renting your property during the slow season, it may require a touch lower price.

If you’re having doubts about your pricing or simply want an extra opinion, reach out to an expert in the field for assistance.

The report can pull a large amount of data for your area quickly so you can stay ahead of the market and find your pricing sweet spot.

Internal property factors are just as important as, if not more than, the external factors listed above. There are some factors that are universally attractive to most buyers, while some are more niche but can help you pull in your ideal tenant. Understanding what increases the value and what doesn’t will help you market your property better.

The features shown below are great ones to highlight in your rental listing — they also indicate that you can price your home higher on the range of market prices (for properties of comparable size):

If your home has too many of the factors listed below, your home may fall on the lower end of market prices. If the factor is fixable, it may be worth investing a little time and money to remedy issues that could lower rent pricing.

Once you’ve priced your home, you want to make sure that your listing justifies the price that you’re asking for. Below are some tips to gain tenant trust and drive the price you deserve.

One of the best ways to make your property stand out is by creating an emotional tie to your home. Put yourself in the shoes of your ideal renter. Do they have kids? Do they care about entertainment nearby? Depending on who your property will appeal to, you’ll want to highlight those features.

There are certain words that jump off the page to renters and help add value to your rental price. See some of those words below:

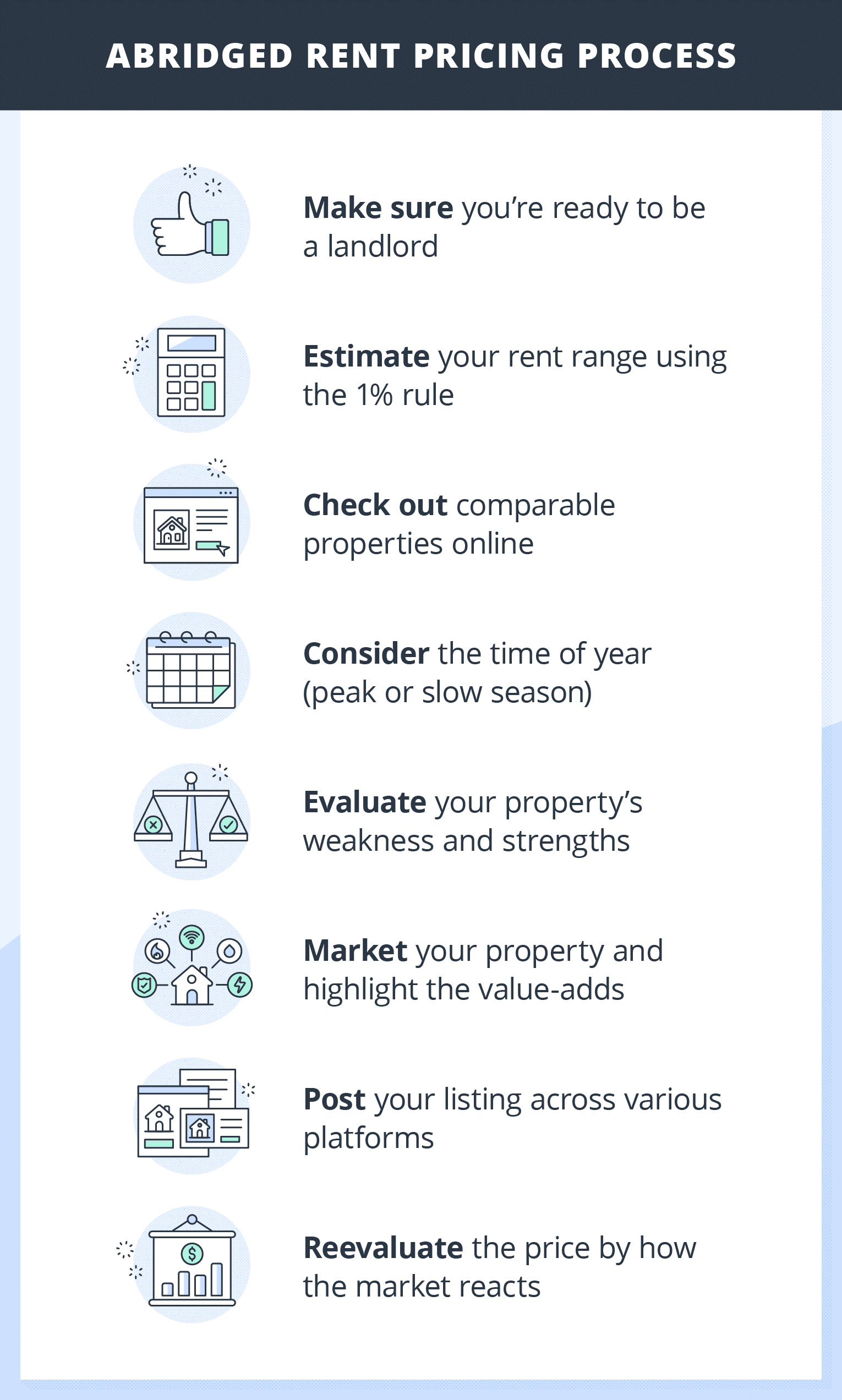

To give you a better idea of how this process would work step-by-step, we’ve organized the different tips laid out above in an easy-to-follow sequence.

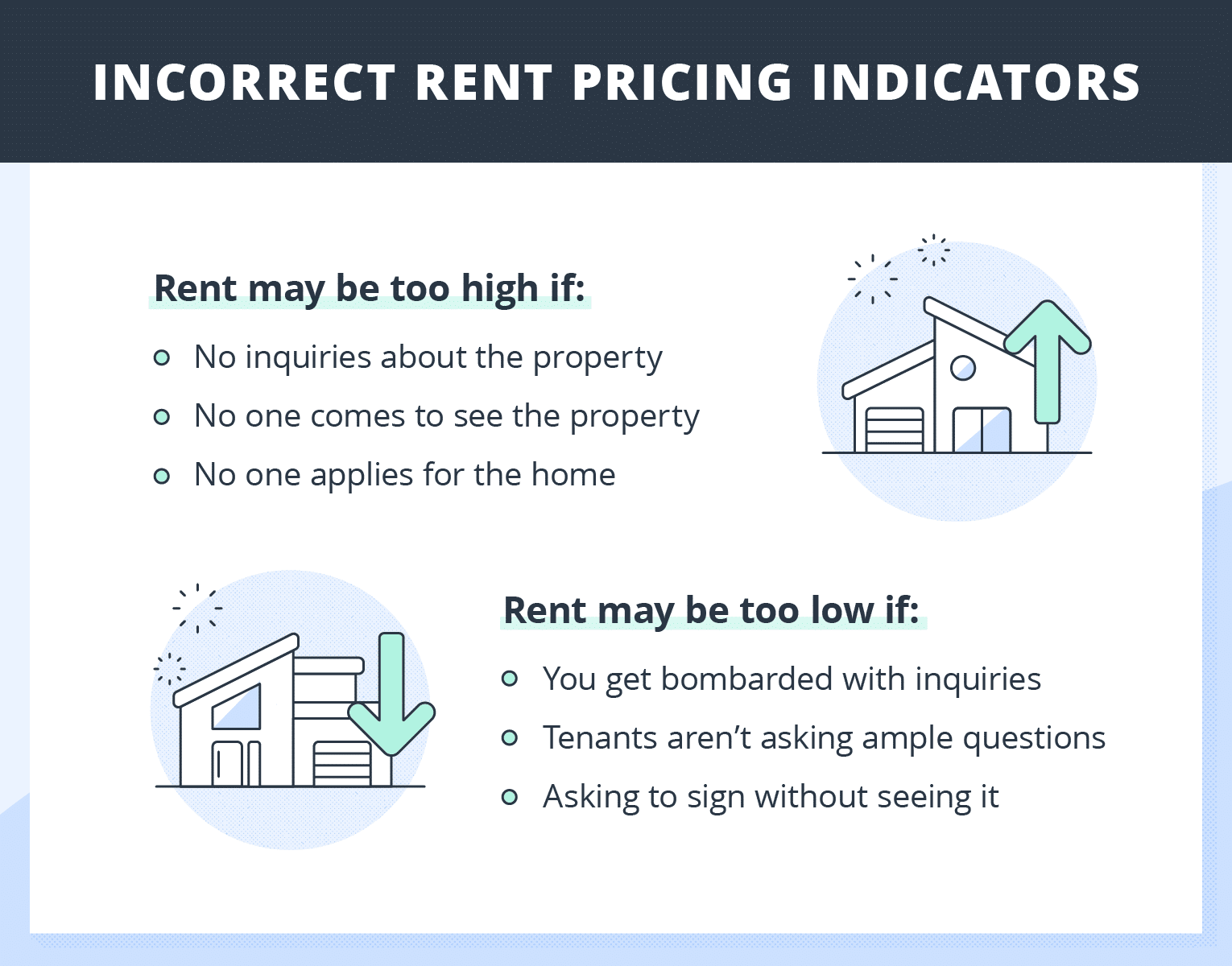

Even after all the research you’ve done, it is sometimes difficult to know how the market will react. You should be willing to adjust your price if you experience some of the following warning signs.

Rent may be too high if:

If this is the case for you it is probably time to lower the rent listing price. An alternative option would be to add value to the home by including expenses, like utilities, or fixing up the property by investing in updated appliances or an in-unit washer and dryer.

Rent may be too low if:

These all indicate that people will still have a healthy amount of interest even if the price was higher, and you may be missing out on profits by pricing your property too low.

The real estate market fluctuates so it’s important to keep up with the rise and fall of prices in your neighborhood. TurboTenant offers a wide variety of resources for landlords to help post your listing, screen tenants and manage your properties all in one place. Create a free account and try it out today!

Marketing. Applications. Leases. Payments.

Marketing. Applications. Leases. Payments.

14 min read

Staying compliant with IRS rules for rental property is a non-negotiable piece of the landlord puzzle. As we all know, Uncle Sam expects full transparency from...

10 min read

If you’re a new real estate investor, you might ask yourself, “Can the IRS find out about my rental income?” The answer...

14 min read

Managing a tenant not paying rent is a frustrating and challenging experience for landlords. It’s especially true if you rely on the...

Join the 700,000+ independent landlords who rely on TurboTenant to create welcoming rental experiences.

No tricks or trials to worry about. So what’s the harm? Try it today!

TurboTenant, Inc., © 2025

Created in Sunny Colorado

Price Your Rental Right With Our Rent Estimate Report!

Find the right price that both optimizes your ROI and helps you find a great tenant. The best part – it’s FREE!