You’ve done it, you’ve taken that first big step toward your entrepreneurial dreams: you have a rental property. Maybe you inherited it, maybe you hung on to it when you moved your residence elsewhere, or maybe a leprechaun granted you a wish.

Regardless of how it happened, you’re now a landlord! Congratulations.

Assuming you already have paying tenants (and if you don’t, we can help!), it’s about this time each year that people start wondering how their taxes are affected by the choices they made in the previous year. Depending on how you’ve structured your nascent rental empire, you may have until April 18, 2024 to file your taxes.

Let’s dig into how your taxes have changed now that you’re a landlord.

Determine Your Rental Business Structure

There are countless reasons you should establish a company to handle the finances from your rental property. We know that it can seem like a big step, particularly if you only have the one rental property (for now), but trust us when we say that establishing business expenses and income as separate from your personal expenses and income is a very wise decision.

Sole Proprietorship

This is the most common business classification, and it’s legal speak for one owner who takes all the business’s profits as personal income. As the owner of a Sole Proprietorship, you’re personally responsible for any business debts. In the eyes of an IRS agent, you and your Sole Proprietorship company are the same entity. Confusing, right?

The good news is that a Sole Proprietorship makes it very straightforward to file your taxes. All you need is a Schedule C (Form 1040) to report your business expenses when you file your personal tax return.

Partnership

If you’re not going alone in your rental business, a Partnership is a good option. The IRS taxes Partnership businesses very similarly to Sole Proprietorships, and a Partnership can have as many owners as it wants. You’re not limited to just one or two buddies when you establish a Partnership, but keep in mind every owner in a Partnership is personally liable for any business debts.

A Partnership is called a pass-through tax entity, and must report profits and losses to the IRS using Form 1065. The Partnership business itself does not pay income taxes but passes that tax liability to its partners. When the partner pays their taxes, they each receive a Schedule K-1 from the Partnership, which is where they report their share of the profits and losses on their Form 1040.

S Corporation (S Corp)

S Corporations are very similar to Partnerships in functionality. The S Corp profits and losses must be reported on a Form 1120-S, but the S Corp doesn’t pay income taxes. Shareholders receive a Schedule K-1 from the S Corp and must pay income taxes on their personal Form 1040.

Limited Liability Company (LLC)

Every state has different LLC requirements and regulations, so your ability to structure your company as an LLC may change depending on where you’re located. Unlike an S Corporation, an LLC can have an unlimited number of shareholders (or members), and each shareholder owns a certain percentage of the company.

The IRS may treat your LLC differently depending on how many members it has. For instance, if you’re the sole owner of a single-member LLC, you’ll be taxed the same way you would be in a Sole Proprietorship. If you’re only one member in a multi-member LLC, you can choose if you want to be taxed as a Partnership or a C Corporation.

Create an LLC online with the experts >>

C Corporation (C Corp)

A C Corporation is a business with an unlimited number of owners, called shareholders. Each shareholder owns a piece of the company and profits are distributed among all of them as dividends. If the owner of a corporation actively works for the corporation, the owner generally would receive a salary, which would be reported on a W-2.

Large companies that dominate business headlines and employ thousands of people are typically structured as C Corps, and it might seem like overkill for your young business. For right now, it might be true that a Sole Proprietorship or an LLC would better fit the bill, but don’t be scared to dream big. Once you’ve got hundreds of employees and properties under your belt, structuring Big Ed’s Rental Properties as a C Corp may make a lot of sense. And honestly, success couldn’t have happened to a nicer guy. Everyone loves Big Ed.

How Rental Income is Taxed

Once you have your business structure ironed out, the big thing the IRS cares about is probably the same thing you care very deeply about: how much money did your business bring in?

If you own a property and rent it to tenants, that rental income is taxed as ordinary income. The IRS considers rental income to be “any payment you receive for the use or occupation of property.”

That means that, in addition to monthly rent, rental income can include:

- Any part of a security deposit that you retain

- Advance payments, such as first and last monthly payments upon move-in

- Expenses paid by your tenants that they aren’t obligated to pay, such as utilities or repairs

Deductions

Deductions are the things you declare on your taxes as necessary expenses for your business to run, and are deductible against your rental income. Deductions cover a huge range of expenses and can have a big impact on the bottom line when it comes to your talks with the IRS. This is where it really pays to keep good track of your business’s expenses (which we can also help with!).

Common deductions for a landlord include:

- Cleaning costs

- Mortgage interest

- Insurance costs

- Advertising costs

- Payments to a property manager

- HOA dues

- Property taxes

- Utilities

- Legal or other professional fees

- Costs of setting up a home office

- Mileage and travel expenses

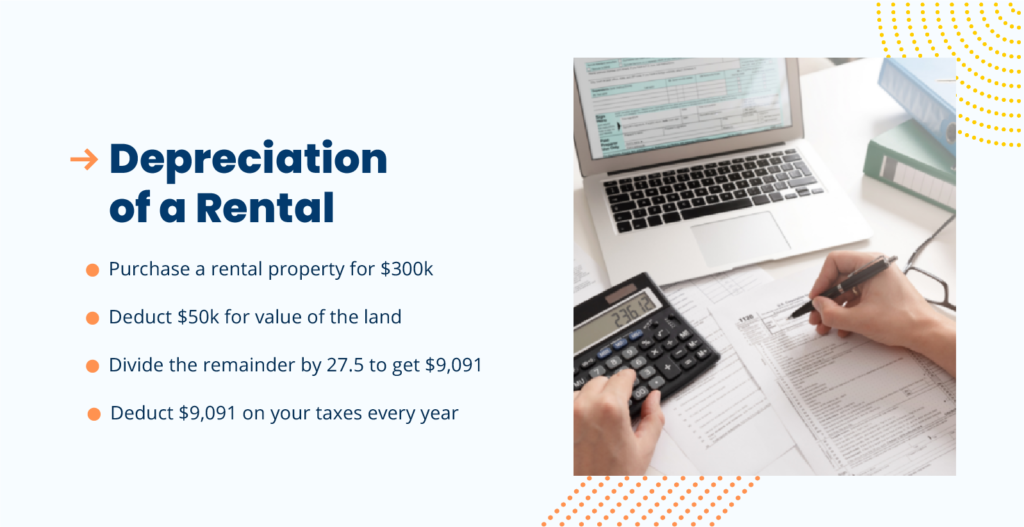

When assets are deemed as having a useful life of a year or more, such as appliances or heavy machinery, then their cost is deducted over time through depreciation. If you bought a $5k printer with a useful life of five years, you could deduct that cost with a $1k depreciation deduction on your taxes every year for the next five years.

But your shiny new rental property isn’t a printer, and it’s going to be pulling in money for a lot longer than just five years. The IRS allows for residential rental properties to be deductible over a period of 27.5 years, which is great news for your taxes.

This means that you can divide the cost of acquiring your property (subtracting the value of the land it’s on) by 27.5 to determine your annual depreciation deduction. For example, if you bought a $300k rental property and the land is worth $50k, then you can deduct $9,091 per year as a depreciation expense. This depreciation expense is on top of the above common deductions.

See? Taxes can be cool.