12 min read

Benefits Of Hiring a Real Estate CPA (+ Costs, Tips & Software)

Whenever tax season rolls around—bringing with it all those dreaded forms and reports—many landlords enlist the help of a real estate tax...

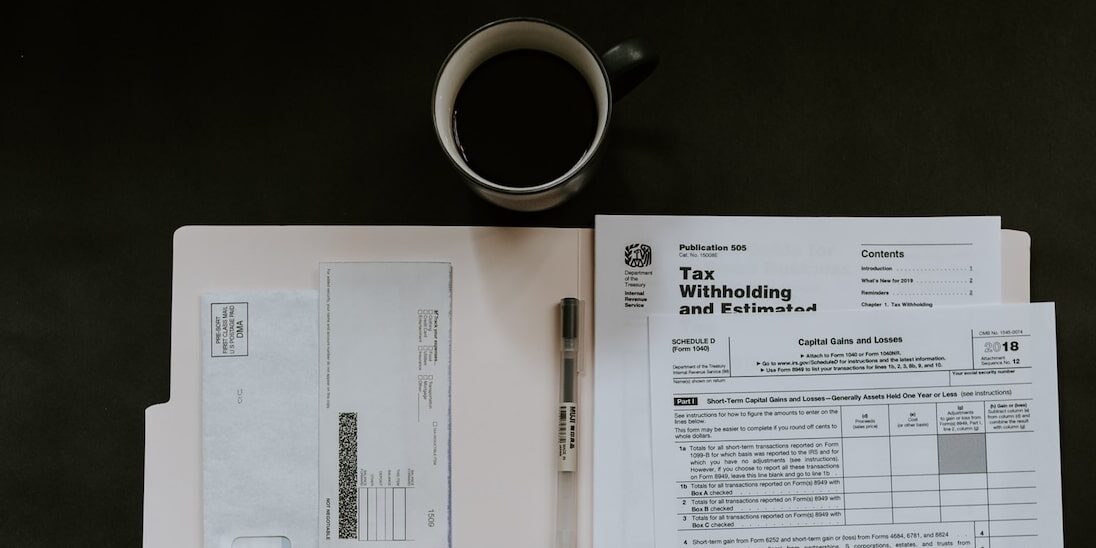

Landlords need to verify that a new renter will actually be able to afford the rent they’re charging each month as part of the tenant screening process.

That’s why asking for several income verification documents on the rental application is so common. Before handing over the keys to their swanky rental unit, landlords will also want to verify the provided proof of rent letter along with the rest of the applicant’s income documentation to protect themselves from fraud.

Keep reading to discover how to demonstrate proof of income along with a free, downloadable proof of rent letter, compliments of the TurboTenant team.

Proof of income is a document or set of documents that verify an individual’s stated wages or earnings.

This documentation is used by landlords to determine a tenant’s ability to pay rent on time. By evaluating a tenant’s monthly income, job status, past payment history, and debt status, landlords can determine if they can rely on the applicant to send digital rent payments every month.

By seeing a renter’s proof of income, landlords can calculate their rent-to-income ratio and see if the applicant would be a good fit for their property. A good rule of thumb is requiring 30% of gross income as a maximum percentage. On top of this, landlords should also run a comprehensive credit check to make sure a potential tenant has a history of making payments on time.

A W-2 is an IRS tax form that must be completed by employers for each of their employees. Employers report total annual wages paid on this form. This document offers valuable insight into an applicant’s overall income status as it depicts a full year’s worth of salary. A W-2 also serves as proof of employment for rental applications.

A 1099-MISC is used to report various types of income someone may receive throughout the year for non-salary positions. Independent contractors and self-employed individuals use this form. A 1099-MISC form can also be a useful way to show proof of income for anyone that earns money from an asset or royalties.

A bank statement for rental applications captures the applicant’s history of deposits and sheds light on any dangerous spending habits. Many tenants may find this method of information verification a bit intrusive as they might not want to show you their spending habits. But don’t worry – there are other ways to verify an applicant’s income for those who feel a bank statement is too personal.

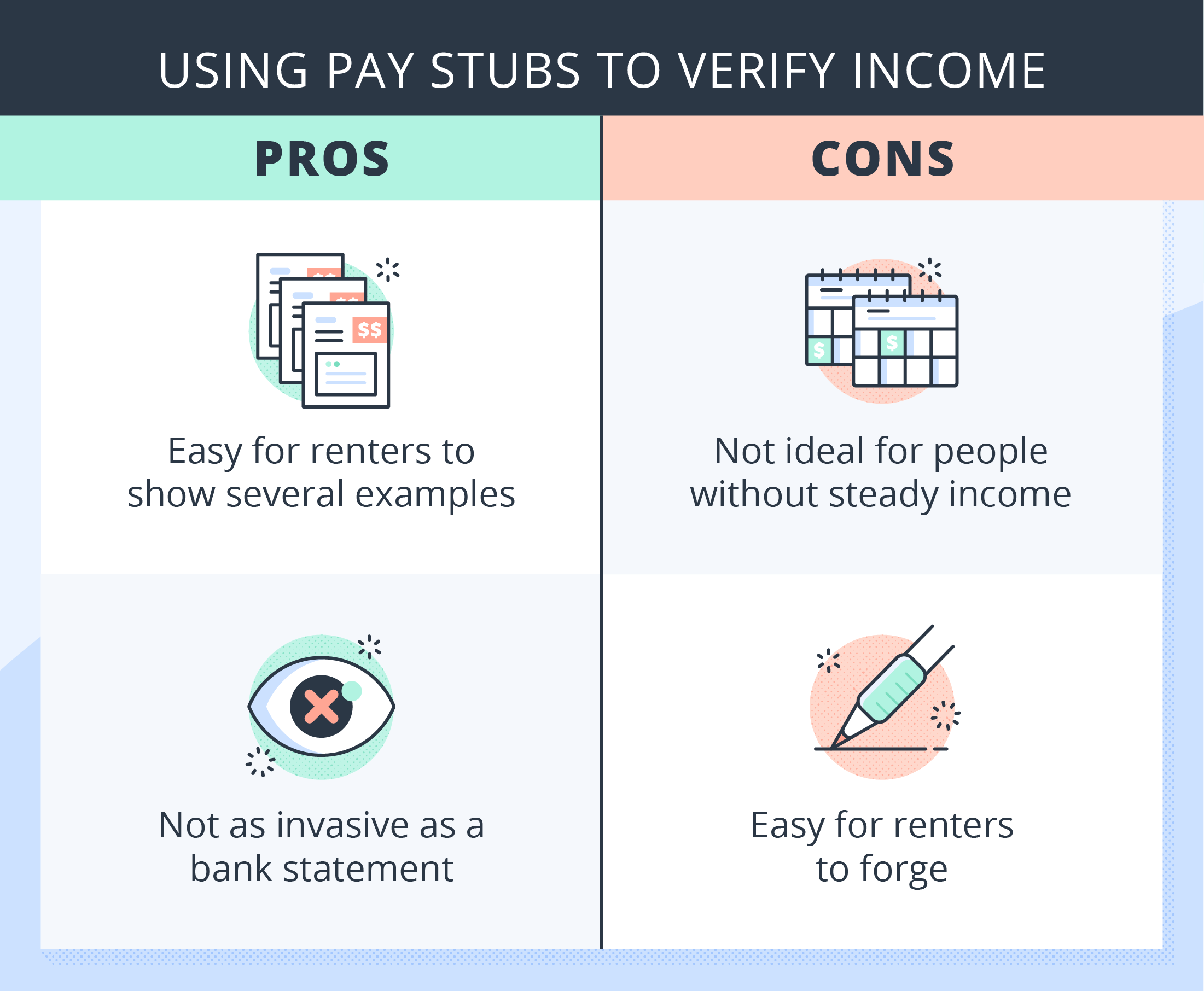

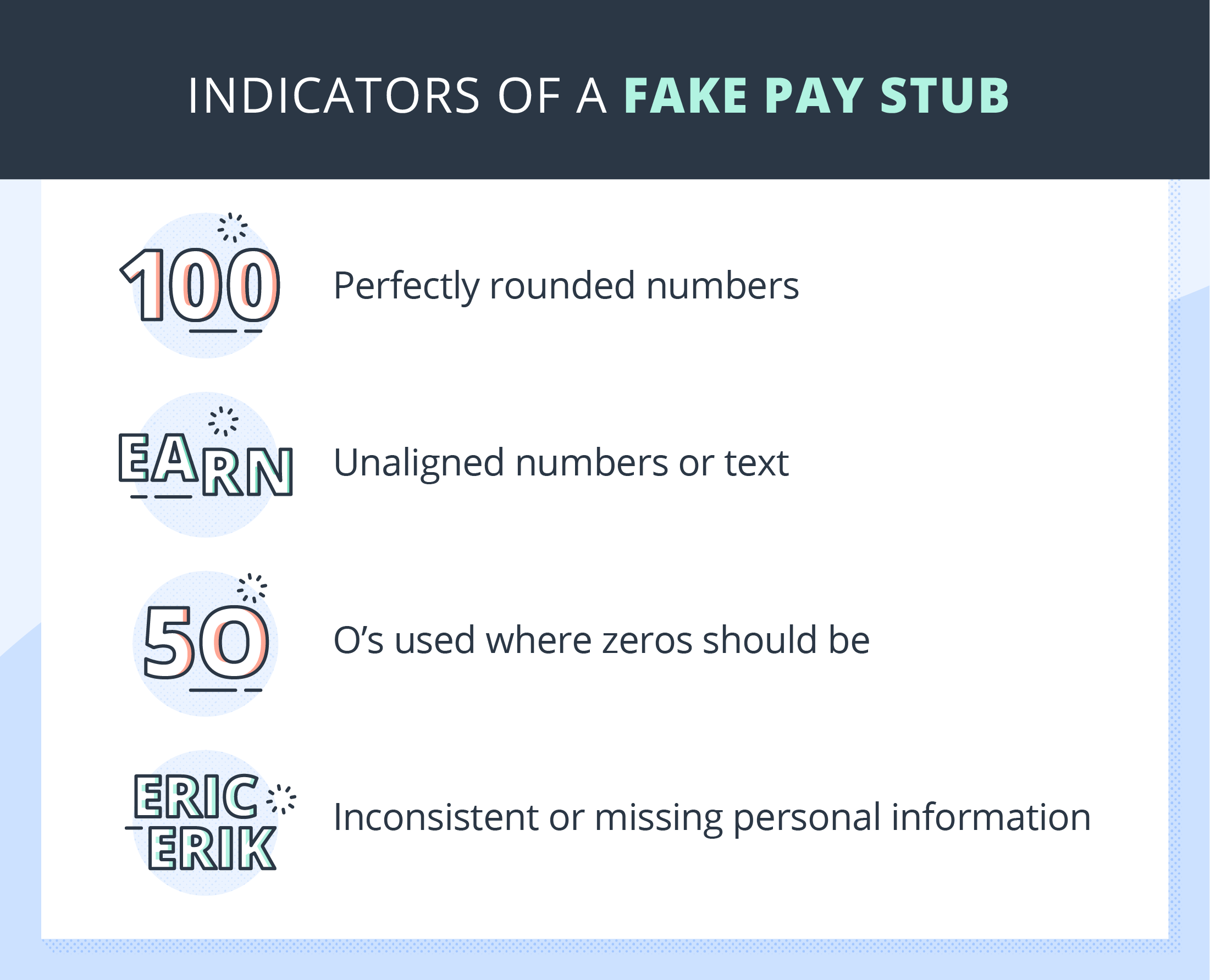

A pay stub, also known as a paycheck or pay slip, is received by employees each pay period and shows their net take-home pay. Pay stubs are easy proof of income for rental applications, but they’re also easy for bad actors to forge. Look out for perfectly rounded numbers, alignment issues, and the use of O’s instead of 0’s when attempting to spot a fake pay stub.

A letter of employment verification for apartment or unit renting is a valid method to show a landlord that the applicant has a stable income and also that this income will remain steady over the lease term. Applicants can request an employment verification letter directly from their employer. To streamline the process, an individual may consider downloading a template and bringing it to the employer. We’ve built your downloadable employment verification for apartment renting template – find it below!

The IRS Form 1040 has a section to report annual income. This document gives an accurate picture of a tenant’s annual income as it shows all sources of income, including income from assets and non-salaried positions. A tenant can request a photocopy of the form or a computer transcript of the information through the IRS.

A Benefit Verification Letter is an official letter from the Social Security Administration (SSA). This letter outlines the monthly benefits income received by the applicant, and it’s a great way for individuals who receive retirement, disability, or Supplemental Security Income (SSI) benefits to prove income.

Workers’ compensation provides lost wages and medical benefits to employees who are injured on the job. An individual receiving workers’ compensation can provide a letter detailing lost wage compensation as verifiable income. It is important to note that while this letter can show steady income for a short period of time, these benefits tend to end eventually.

For renters who have commission-based jobs such as real estate agents, another option would be to show documents related to their bonus and incentive payments. Sometimes commission-based jobs do not have consistent payments, which is why it’s important to see if they can afford and be able to pay the rent on time every month.

An unemployment statement can be a convenient way for renters who are out of a job to show proof of income. All renters need to do is provide the statement sent by the state unemployment office. Unemployment funds are guaranteed money, but landlords should still check the dates on the statement to see how long the benefits are set to last.

Unfortunately, it’s easier than ever to create fake income verification documents online. Tenants can create fake pay stubs in about one minute using various free or inexpensive online tools. That’s why it’s crucial for a landlord to do their due diligence when reviewing income verification documents and maintain a robust tenant screening process.

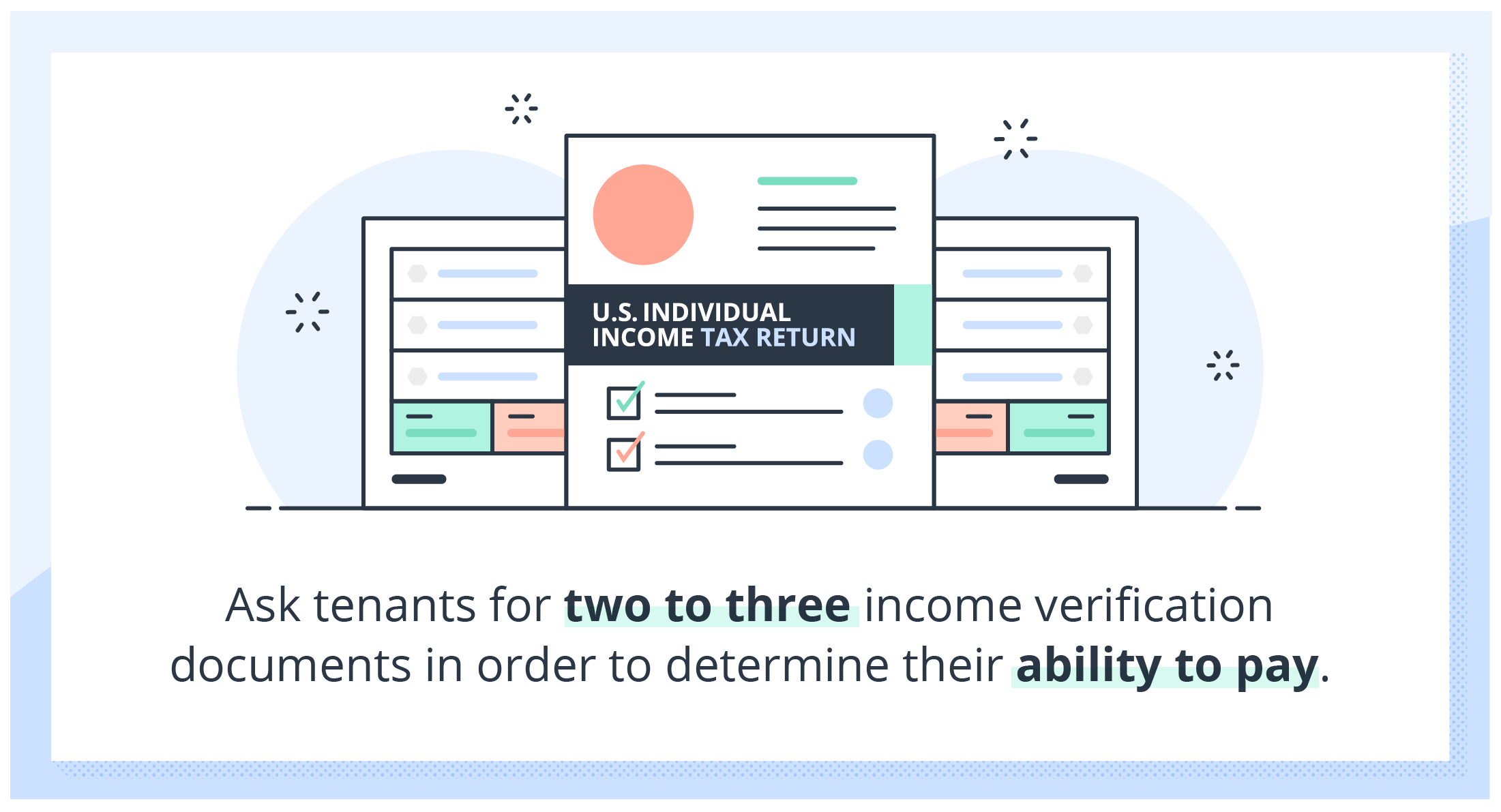

Obviously, there is no need for landlords to require ten different income verification documents. Depending on the monthly rent, landlords should ask for two to three proof of income documents.

For individuals who are currently working, it makes the most sense to ask to see several pay stubs or a W-2 and a tax return. For elderly renters, a landlord will need to verify a Social Security Benefits Statement, and for injured workers, a Workers Compensation Letter. For expensive rentals, landlords may also want to consider asking for a bank statement.

Here’s a handy template that landlords can download and give to their tenants to have employers fill out. You can include this form along with the rest of the lease paperwork for your new tenants to sign.

Our letter is in a pdf format, and easy to print and fill out.

It is crucial for landlords to not only ask for proof of income documents from renters but to also look out for fake income verification documents. TurboTenant offers a number of tools to make this process easier for both landlords and renters. In fact, TurboTenant landlords can find a standard rental application and screen tenants for free.

TurboTenant landlords with a Premium subscription also have access to TransUnion’s Income Insights with every screening report.

Along with documents that verify your identity, you’ll need to provide evidence that you can pay the monthly rent as outlined in the unit listing, which could include employment verification for apartment rentals, pay stubs, unemployment benefit summaries, etc.

If an applicant is unable to provide bank statements or pay stubs due to cash payments, providing your tax documents that show your annual income should suffice along with one of the other ways we listed above.

If you don’t have pay stubs to show proof of income, there are a variety of other ways you can do it. Ask about using an employee letter, a W-2, bank statements, and any other document we listed above. Be sure to communicate during this process to ensure the right documents are provided and accepted.

Landlords ask for bank statements within rental applications as a way to verify that a potential tenant has the funds available to make monthly rent payments.

Your landlord may call your employer to go over an employment verification for an apartment or unit rentals if you decided (or were required) to submit this kind of documentation.

Yes, renters can use unemployment documents as proof of income, but landlords should still ensure the potential tenant will be able to afford the monthly rent price and take note of when the benefits are set to expire.

Landlords need to always follow Fair Housing laws when choosing who to rent to, but renters should understand that showing proof of income is an industry standard for renting. Landlords need to protect their investment by double-checking the renter can afford to make on-time rent payments monthly. Always set screening criteria as a landlord so you can find the best tenant for your property.

12 min read

Whenever tax season rolls around—bringing with it all those dreaded forms and reports—many landlords enlist the help of a real estate tax...

13 min read

Investing in real estate can be a great way to diversify your investment portfolio, although many people don’t take advantage of doing...

15 min read

There are many moving pieces to consider as you make your next rental agreement. For starters, you must ensure your lease agreement complies with state...

Join the 700,000+ independent landlords who rely on TurboTenant to create welcoming rental experiences.

No tricks or trials to worry about. So what’s the harm? Try it today!

TurboTenant, Inc., © 2025

Created in Sunny Colorado