14 min read

IRS Rules for Rental Property: Landlord Tax Guide for 2025

Staying compliant with IRS rules for rental property is a non-negotiable piece of the landlord puzzle. As we all know, Uncle Sam expects full transparency from...

These days cohabiting before marriage is becoming the norm, especially among younger couples. When couples live together in a rental, it makes sense that they would split the rent payment. But what about when one party actually owns the property? This can lead to some tricky conversations, as some might view charging their partner rent as bad for the relationship.

In order to find out what people think about this scenario, we conducted a survey of 1,000 consumers to see if they would charge their partners rent to move into their home. Surprisingly, most reported that they would!

Below are some of the key breakdowns from the survey:

The stat that more than half of couples would charge their partners rent is shocking, given the fact that moving in together is considered a significant step forward in a romantic relationship. Though it’s true that moving in together before marriage is not as scandalous as it was a few decades ago, it still indicates a high level of trust as well as plans to be financial partners in the future. Charging a romantic partner rent can create an unbalanced dynamic, considering that money is consistently reported as one of the top things couples fight about.

Though close to half of partners would charge their significant other rent, the demographic breakdown of the “would charge” respondents skews heavily toward women.

Interestingly enough, nearly 60% of the “would charge” respondents were women. Since less than half of men would charge their partners rent, this perhaps shows a reluctance to vacate the traditional male role of financial provider. In contrast, women are stepping away from these roles by becoming a force in the housing market. Single women now make up 18% of total homebuyers (while only 7% are single men), demonstrating a shift in conventionally male-dominated property ownership.

Since younger generations are often looked down upon for their presumed selfishness and obsession with self-image, this next stat may surprise you.

The most significant generational takeaway comes from millennials, as 63% reported that they would not charge their partners rent to move into their property. This is most likely due to millennials’ more forgiving attitude toward finances, as they face unprecedented student loan debt that some predict could cause another economic recession.

In contrast respondents in the 45 – 65+ age range had over a 60% “yes” response rate, indicating that older generations remain conservative with their finances. Millennials are also more likely than older generations to purchase a home with their partner before they are married, a move that many would see as financially risky. This study shows that nearly 1 in 4 millennials purchased a home with their significant other before marriage, as opposed to those ages 45+ at 14%.

Despite the trusting spending habits exhibited by millennials, cohabiting couples across generations are still taking steps to ensure they are protected when living with a partner.

Cohabiting before marriage is much more common these days than it was even 20 years ago. A CDC study reports that nearly 75% of women under the age of 30 have lived with a partner outside of marriage, up from 62% in 1995. Although living with a boyfriend or girlfriend is becoming the norm, cohabiting couples aren’t necessarily planning to get married anytime soon. This is exemplified by the stat that over one-third of couples want separate rental agreements. Though they are in a committed relationship, many couples aren’t ready to combine their finances just yet.

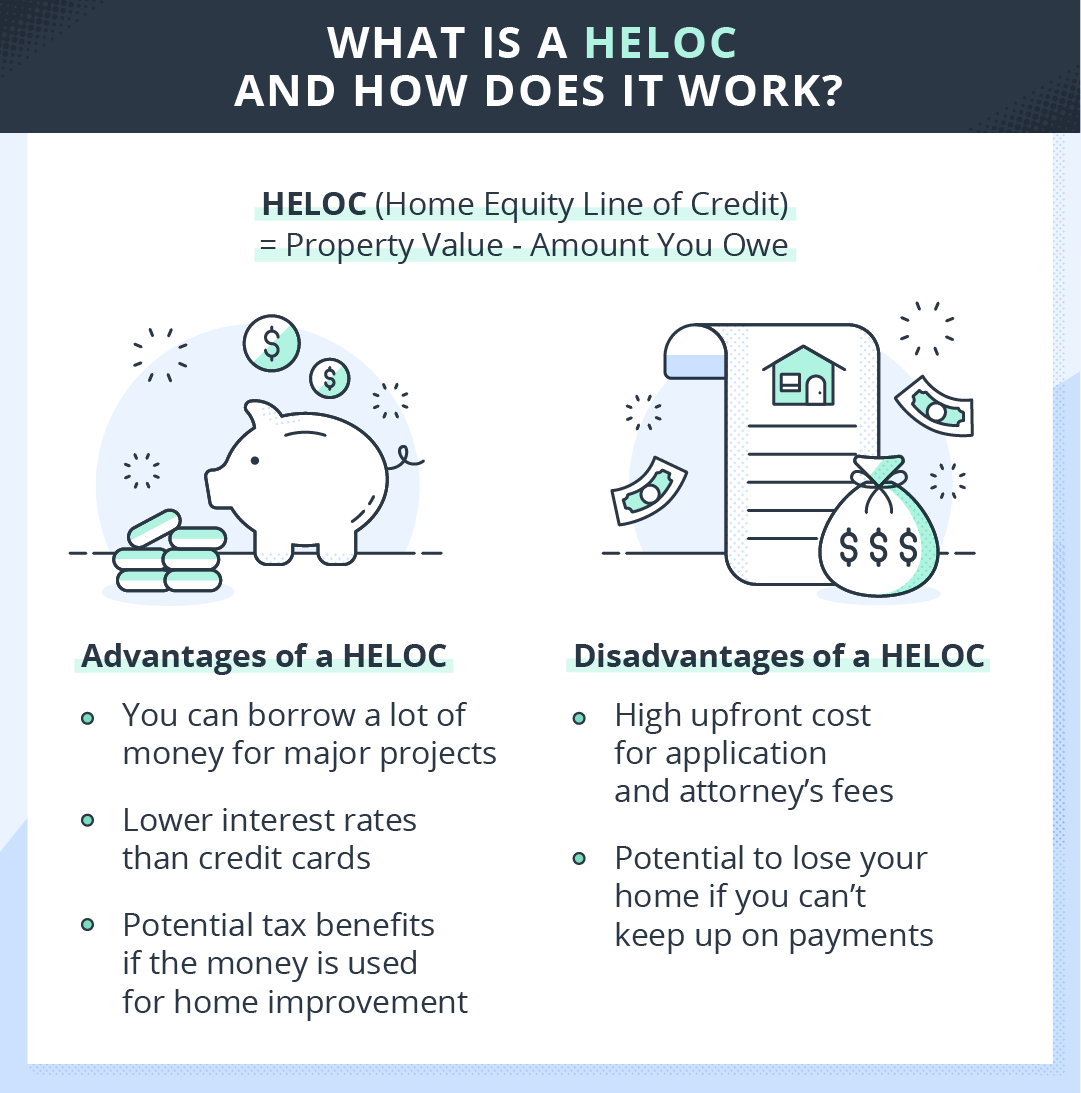

Though it makes sense on the surface, charging a partner 50% of the mortgage as rent each month actually unfairly benefits the owner of the property. This is because the property owner is gaining equity on the home while getting half of their mortgage paid for, while the other partner has no legal stake in the property. While the home is being paid off, the property owner will have access to a greater home equity line of credit (HELOC) allowing them to take out larger loans or consolidate high-interest debt on credit cards.

In addition, the property qualifies as a “premarital” asset since the property owner purchased it on their own. If the couple were to get married, live in the home, and get divorced after 10 years, the non-property owner would be entitled to none of the assets from the home since it was purchased before marriage. This would mean that that partner essentially paid half of a mortgage with nothing to show for it!

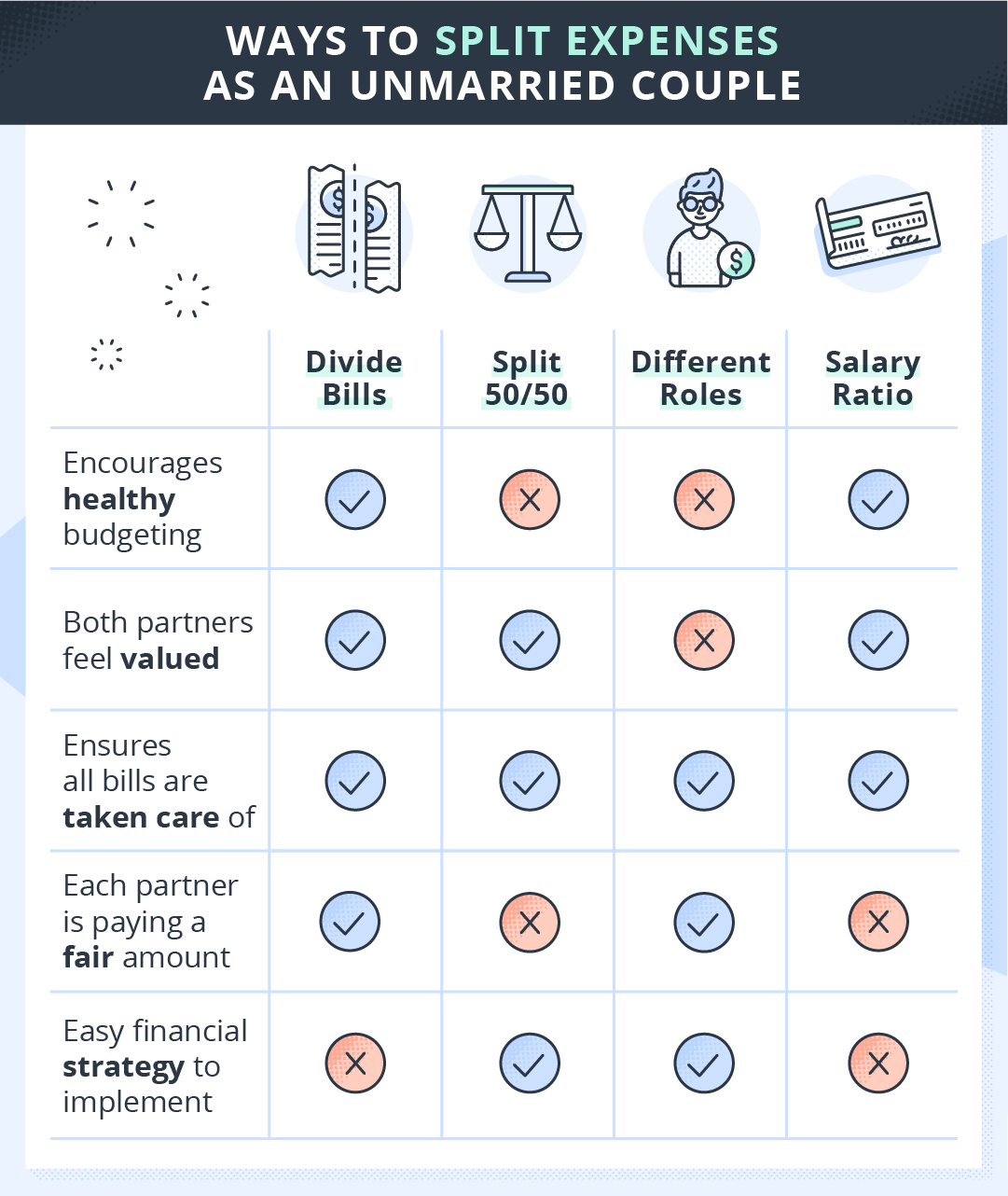

Though figuring out finances can be tricky as an unmarried couple, there are certainly a number of ways to work things out fairly for both parties. Below are a few of the most popular ways couples divide up property expenses:

In order to avoid the issues outlined above, a couple can enter into a “tenant in common” arrangement. This type of legal agreement allows both partners to own the property together. Each partner would be entitled to their percentage of the property, but not to their partner’s percentage. This can turn into a sticky situation if the couple breaks up as one may decide to sell their share of the interest, but it’s a good way to overcome the unequal benefits of simply paying half of the mortgage every month.

Though this method won’t work for larger bills like rent and shared car payments, a good way to make sure each partner feels like they are spending fairly is to divide monthly expenses based on who uses them more. For example, if one partner only watches Netflix but the other needs their premium sports channels than each should pay for their separate TV subscriptions. If one partner insists on having a family gym membership but the other never wants to go, than the first partner should pay for the membership. This is a good way to put each partner’s spending in perspective.

No doubt the simplest way to break up the budget, this is a good option if both partners make similar salaries and own similar assets used by both couples (ie each has their own car or each has a stake in shared property). It can be tempting to go with the 50/50 split in order to limit conversations about finances, but this type of arrangement can lead to frustration later on if one partner is making significantly less than the other.

Hearkening back to the traditional husband-wife roles, this type of arrangement can work well for many couples. If one partner has a secure, high-paying position that requires a lot of work hours, it may make more sense for the other partner to handle the home life that the other doesn’t have time for. Whether it be taking care of kids, pets, cooking, cleaning, managing shared property, or whatever the couple’s needs are, it will be important for couples in this situation to recognize the value of the others’ work and contributions to the home.

This is the most financially-complicated way to split expenses, but it is also the most logical. If one partner makes $30K/year as a public school teacher and the other is bringing in $125K as an engineer, it does not make sense for them to be splitting expenses equally. Though it’s a daunting task, this arrangement requires the couple to sit down and calculate the percentage of monthly expenses each will be paying. In the end however, it can make each partner feel more satisfied with their contribution.

As the demographics of the property owner landscape shift and more couples turn away from traditional relationship stages, paying rent, mortgages, and other bills becomes more complicated. It will be interesting to see how these trends change over the next decade as millennials and women continue to take up more real estate. Stay up-to-date on the latest landlord trends and tools with TurboTenant.

DISCLAIMER: TurboTenant, Inc. does not provide legal advice. This material has been prepared for informational purposes only. All users are advised to check all applicable local, state and federal laws and consult legal counsel should questions arise.

Methodology: This finance study was conducted for TurboTenant using Google Consumer Surveys. The sample consists of 1,000 respondents, with an average margin of error of 4.1 percent. This survey was conducted August 2019.

14 min read

Staying compliant with IRS rules for rental property is a non-negotiable piece of the landlord puzzle. As we all know, Uncle Sam expects full transparency from...

10 min read

If you’re a new real estate investor, you might ask yourself, “Can the IRS find out about my rental income?” The answer...

14 min read

Managing a tenant not paying rent is a frustrating and challenging experience for landlords. It’s especially true if you rely on the...

Join the 700,000+ independent landlords who rely on TurboTenant to create welcoming rental experiences.

No tricks or trials to worry about. So what’s the harm? Try it today!

TurboTenant, Inc., © 2025

Created in Sunny Colorado