12 min read

Can a Landlord Change a Lease After It Has Been Signed?

If you’re asking, “Can a landlord change a lease after it has been signed?” we’re glad you stopped by to find out....

In most states, rental application fees are paid by individuals interested in renting a house or apartment during the screening process. This fee typically covers the cost of background checks and screening services performed by landlords to ensure that tenants are a good fit for their property.

When you hear the word “fee”, you’re probably less than excited. When it comes to rental application fees, we know that renters don’t like paying for them and landlords dislike charging them. However, it’s important to know the fees aren’t just a price-gouging tool used to collect money from renters, but rather they add value and security to the rental application process and cover the administrative costs of screening a tenant.

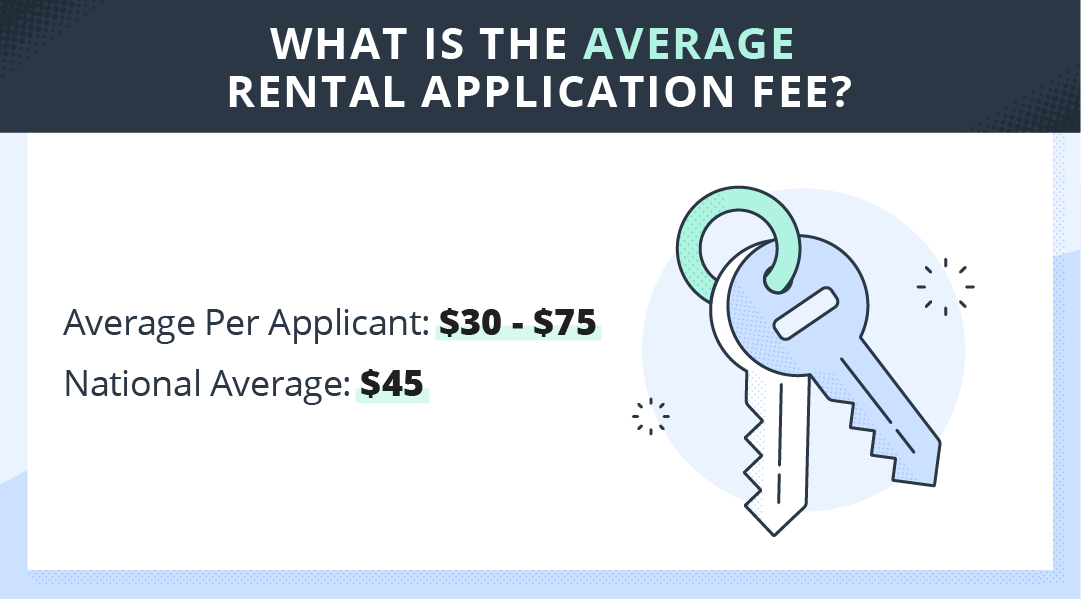

Rental application fee laws vary by state, but they can cost anywhere from $30 – $75 per applicant. These fees are in place to allow landlords to screen their tenants, and going through this process will save everyone time and money in the future.

Keep reading to find out everything you need to know about rental application fees:

Rental application fees may seem like an unnecessary and greedy part of the landlording process – especially since moving can be costly for renters in many ways. But just having tenants fill out a rental application form isn’t enough; there are more precautions landlords should be taking.

Rental application fees are generally used for tenant screening, which protects landlords and all prospective tenants. Tenant screening is essential for landlords to know the criminal background, credit history, and possible evictions of applicants. Landlords must ensure that their properties, other tenants, and the general community around the rental are protected from a variety of situations. As a tenant, you’ll feel better knowing your future neighbors and other tenants living on the property are responsible and trustworthy as well.

The rental application fee is usually used for tenant screening which includes a background check, credit check, and often an eviction report. This is essential information for landlords to be aware of before they sign a lease agreement with a tenant – they need to know of any red flags beforehand and trust that their tenants will be able to pay rent on time each month. To receive a background and credit report, landlords must go through third-party service. Sometimes application fees will cover the administrative fees as well, but this can vary from state to state.

The average rental application fee is $45, but there are a variety of factors that go into deciding the fee price. There are sometimes different levels of tenant screening that would cause the screening fee, and therefore the application fee, to cost a little more. For example, some just include background and credit reports while others also include past eviction reports.

Rental application fees minimum and maximum caps vary state by state. Most states have no limits or regulations on what a landlord can charge for an application fee, but some have strict rules. Make sure you check your local rental fee application laws in advance to avoid any trouble.

It can be challenging to navigate rental application fees, especially since renters incur many different moving costs and landlords prefer not to charge for them. However, following best practices can smooth the process for everyone involved.

Before you pay an application fee, you want to make sure you know all the details and your rights as a tenant. Hopefully, the landlord is transparent and honest, making it easier to understand the involved fees.

There are several things landlords should remember when it comes to application fees to make sure you are running a professional and successful business:

For most states rental application fees are allowed, however, in some they are illegal, and in many, there are certain limits or maximums that must be followed. Not only are there state laws, but regulations can vary across local regions, so make sure to complete thorough research before you set your fees.

You can check your state’s rental application laws here – however, make sure you check official websites and also local statutes. Laws can and will change.

Sometimes. They can be refundable and non-refundable depending on your state laws – usually, landlords do not have to refund the application fee if they reject the tenants.

Once again, this depends on your state – in certain states such as Massachusetts, application fees are illegal – double check to be safe.

Yes. A landlord can charge a rental application fee per tenant since they will need to run separate screening reports on each individual. Keep in mind the Fair Housing Act requires that you have the same application processes and fees for each applicant.

Overall, rental application fees are an essential part of the rental process and without them, screening would not be possible and landlords would not be able to verify the financial or criminal status of a prospective tenant. If you want to learn more about rental application fees or have any questions, visit TurboTenant.

DISCLAIMER: TurboTenant, Inc does not provide legal advice. This material has been prepared for informational purposes only. All users are advised to check all applicable local, state, and federal laws and consult legal counsel should questions arise.

12 min read

If you’re asking, “Can a landlord change a lease after it has been signed?” we’re glad you stopped by to find out....

11 min read

Whether you’re selling a rental property, switching to property management software, or simply tired of paying 8% to 12% monthly recurring fees, you’ll...

12 min read

If you came here seeking an answer to the question, “What does a property manager do?”, you’re not alone. Managing a rental...

Join the 750,000+ independent landlords who rely on TurboTenant to create welcoming rental experiences.

No tricks or trials to worry about. So what’s the harm? Try it today!

TurboTenant, Inc., © 2025

Created in Sunny Colorado

Accept Rent Online!

Don’t waste time dealing with checks or coordinating pickup times.

TurboTenant is a safe and convenient way to automate rent collection.