14 min read

IRS Rules for Rental Property: Landlord Tax Guide for 2025

Staying compliant with IRS rules for rental property is a non-negotiable piece of the landlord puzzle. As we all know, Uncle Sam expects full transparency from...

As a landlord, you’ll be lost come tax season if you aren’t tracking your rental property expenses correctly. Keeping detailed rental expense records will not only help you feel more organized but it will also make filing your taxes easier, allow you to discover more opportunities for deductions, and calculate the ROI for each of your investments.

In this article, we’ll cover:

Use our efficient and accurate property management software to streamline all of your accounting, bookkeeping, and expense tracking needs.

Use our efficient and accurate property management software to streamline all of your accounting, bookkeeping, and expense tracking needs.

While it might seem like common sense to track your rental property expenses as part of the rental management process, there are additional benefits to consider. You should maintain detailed rental property expenses to:

Your future self (and CPA) will thank you for accurately keeping track of your rental property expenses. Not to mention, you’ll avoid the headache of going back in time to calculate gas money or find receipts.

There are only two ways to track your rental property expenses: manually or with the help of online tools.

Keeping track of your rental property expenses manually used to be the only way to do it. And when we say manually, we mean creating your own spreadsheets on Excel or Google Sheets, or even doing it by hand with a worksheet. Along with writing in expenses manually, you also have to keep receipts organized in a folder online, which may require scanning them, or in a physical file somewhere.

Keeping track of expenses manually can become stressful and not to mention extremely time-consuming. Luckily, in the age of virtual landlords, there are other options out there.

The alternative to tracking your rental expenses manually is to use an online tool like TurboTenant. Online expense tracking tools were built to be fast, secure, and help you prepare for tax season. Your hand won’t cramp from writing in expenses, and you won’t have to worry about stapling receipts anywhere.

Plus, if you manage other aspects of your property online like tenant screening or rent payments, tracking your expenses in the same place will be convenient.

Pro Tip:

Did you know you can appeal your property taxes, but only have a short time to do so? Learn more with Ownwell, and save on your next tax bill!

When it comes to what you should be keeping track of, it comes back to the Schedule E Form. This form is used to report income or loss from rental real estate. For expenses to be deducted, they must be tied to a rental property as you file a Schedule E form for each property you own.

Here are some of the categories listed on the Schedule E you should be tracking:

All your marketing costs (including for rent yard signs, advertising on certain websites, or sending out mailers) fall into this category.

Driving, along with other necessary and ordinary auto and travel costs needed to maintain your rentals, would qualify in this category.

This section includes all the cleaning expenses incurred after a tenant moves out as well as common maintenance expenses like yard work, painting, and other upkeep or maintenance requests you tend to.

This refers to the real estate agent or property management commissions you paid to help find a tenant. If you use free online rental property marketing, you’ll have less to add in this section!

You should have landlord insurance along with any other policies your unique rentals require, like hazard or flood policies. Remember that this is the amount you actually paid to your insurance company (not what you pay in escrow).

If you have a property manager or agent helping manage the property, their 8-12% of your monthly rental income charge would be included in this category.

Any expenses related to accounting, attorney fees, or other business costs related to your tenants qualify for this category.

This includes utility expenses you have incurred, even if your tenant reimbursed you for them. Do not include utilities that the tenant has paid for solely themselves.

All of the tax expenses you have accrued from owning and operating your rental property such as property taxes, land taxes, school district taxes, or special easements can be included in this category. This does not include income taxes.

Tracking repairs made to the property that were not considered “capital improvements” would be in this category. For example, small repairs like fixing a broken window is a repair – not large renovations like replacing floors or the roof, which would have to be taken as deductions over time.

The above is not an exhaustive list of everything you should track as there are more categories on the Schedule E form (not to mention, you may want to track additional expenses not listed on the form.

Another thing to consider is how often you should be tracking expenses. Ideally, you should always be tracking your rental expenses as they occur, however, choose a cadence that works best for you whether it’s as you go or monthly. Tracking your expenses monthly when you are also tracking your online rent payments is a great way to start.

If you are ready to make the move to tracking your rental expenses online, you can easily do so in your TurboTenant account. Below we’ll walk you through how to start tracking expenses:

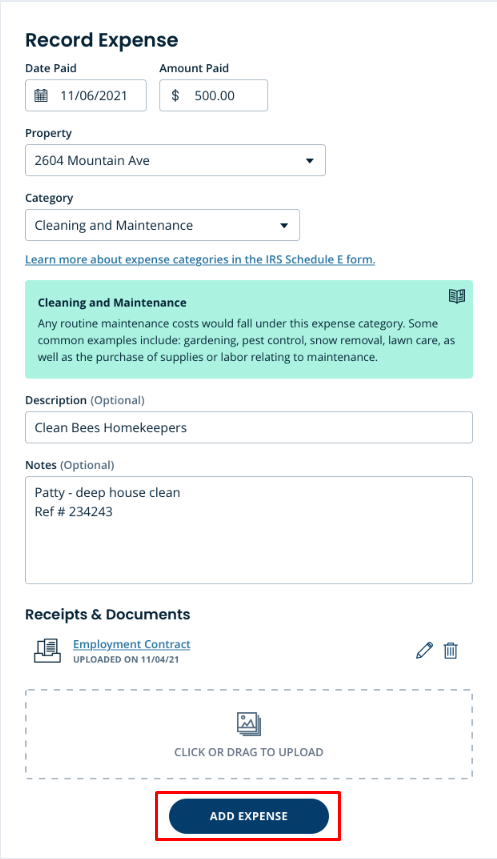

Locate the expenses tab in your dashboard – it will be on the bottom left-hand side under Financial. To record an expense, click add new and then record expense.

You will then input information related to the expense including the date it was paid, the amount, the associated property, and the associated category (corresponding to the Schedule E Form). You will also be able to add receipts or any other important documents for each expense.

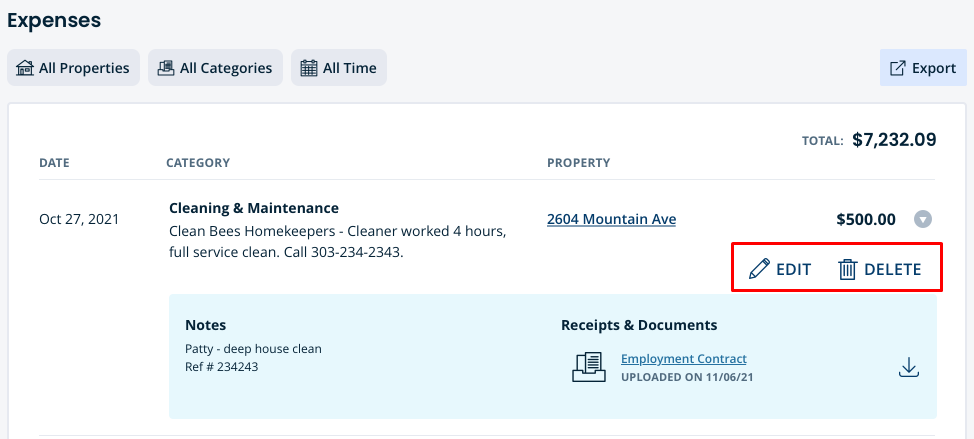

In the expense table, you can edit, delete, and filter expenses by categories, property, or date ranges.

Now that you have all of your rental property expenses correctly categorized, you can export the expenses you tracked to give them to your CPA or upload them to any financial software you use.

All you have to do is click the “Export” button in the top right-hand corner and our software will download your CSV. Whether you want to export weekly or monthly, you can upload the CSV to the bookkeeping software of your choice.

Alternatively, you could leverage REI Hub through TurboTenant. For a low monthly charge, REI Hub will allow you to transfer all your TurboTenant expense tracking information and streamline your financial reporting in just a few clicks.

Long gone are the days of digging for receipts and scrambling to find the right documents for your rentals when tax season rears its head.

Tracking your rental expenses with TurboTenant will allow you to manage all aspects of your business in one place to maximize your tax deductions and increase the ROI on your rental investment.

When you own and manage a rental property, there are several types of expenses that you will incur. You’ll have expenses related to your business such as legal and property management fees, and also expenses related to the property itself like maintenance and utilities.

To find out the category and type of rental expenses you can deduct, reference the Schedule E Form from the IRS.

Yes, it is completely free to use TurboTenant’s expense tracking feature. You can also take advantage of automatic expense tracking (and rent payments) with our paid integrated accounting tool.

14 min read

Staying compliant with IRS rules for rental property is a non-negotiable piece of the landlord puzzle. As we all know, Uncle Sam expects full transparency from...

10 min read

If you’re a new real estate investor, you might ask yourself, “Can the IRS find out about my rental income?” The answer...

14 min read

Managing a tenant not paying rent is a frustrating and challenging experience for landlords. It’s especially true if you rely on the...

Join the 700,000+ independent landlords who rely on TurboTenant to create welcoming rental experiences.

No tricks or trials to worry about. So what’s the harm? Try it today!

TurboTenant, Inc., © 2025

Created in Sunny Colorado

The All in One Solution for Landlords

Over 550k landlords use TurboTenant to get leads, screen tenants, create leases, and collect rent — all in one place.