4 min read

Meet the TurboTeam: Goran Maksimovic

And then you realize that the people are your source that you’re learning from. And the people keep you in company and...

In this edition of The TurboTenant report, we will be focusing on the best places to buy an investment property in California. Seven towns made our list: Hawthorne, Los Angeles, San Diego, San Jose, Long Beach, Bakersfield, and Santa Maria. We curated data from studies on the best places to buy an investment property, median sale prices, and proprietary TurboTenant data. The TurboTenant Data includes stats on the average number of leads a rental property received, as well as the average number of days on the market. These two points will help an investor determine the strength of the rental market, as well as estimating potential vacancy rates.

California is the most populated state in the U.S. – this makes sense as it attracts people from all over for its great climate, thriving and diverse communities, beautiful landscape, strong entertainment industry, and, of course, the ocean. While California is known for its tourism, it is also a hub for agriculture, biotechnology, natural resources, and much more. Whether it’s visiting one of its national parks, chilling at the beach, or going to a Lakers game, California truly has it all.

Like the Eagles famously penned, California is a lovely place – you probably won’t ever want to leave. Let’s take a look at the best places to buy an investment property in The Golden State.

The Best Cities to Buy an Investment Property in California

Hawthorne is known as the “Hub of the South Bay” and it is also the home of the iconic Beach Boys. Its convenient location close to Los Angeles provides all the amenities of LA with a much lower average rent. Since it has some of the best and most moderate temperatures in California, it is a hot-spot for both short-term and long-term properties. Rentals are expected to be filled quickly with a high number of leads per property and less than two weeks on the market. “Wouldn’t It Be Nice” to property invest in Hawthorne?

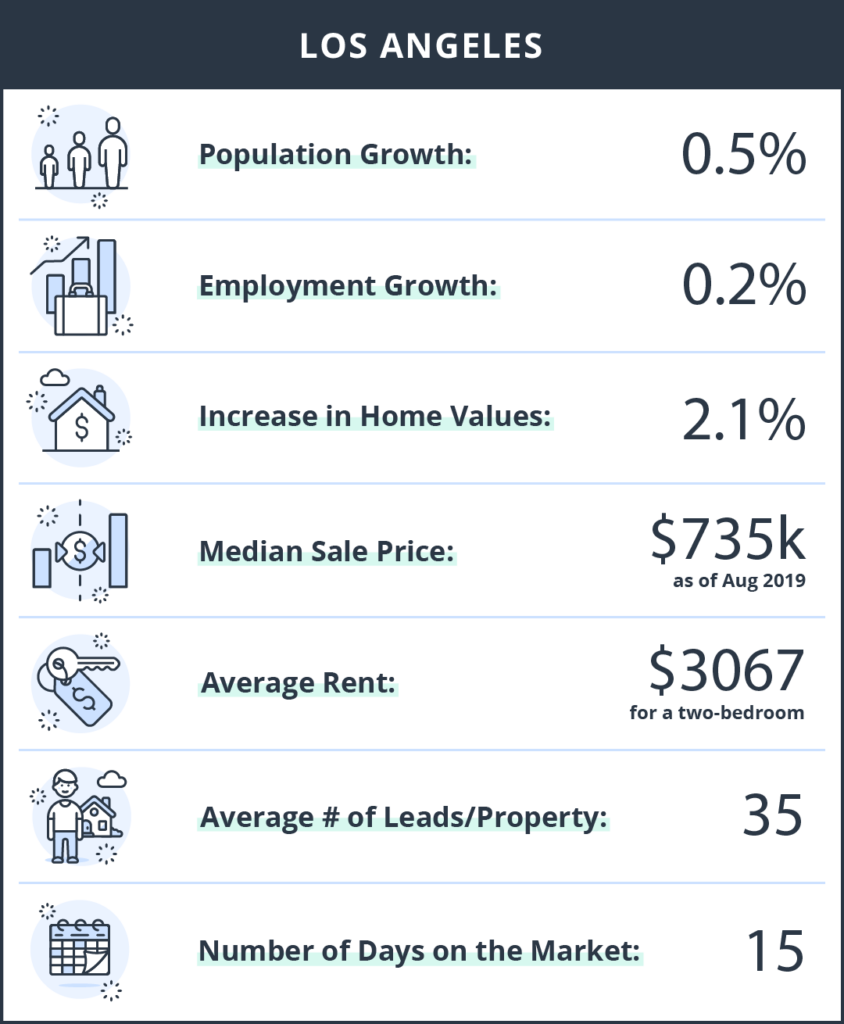

Los Angeles is known for many things throughout the world: entertainment, Hollywood, the LA Dodgers, the Summer Olympics. This cultural hub is also a leader in several industries – for example, LA county employs more than 87,000 people in the fashion industry, along with more than 700,000 workers in a variety of tech industries. With a steady population and employment growth, rental properties are a must in LA and with home values increasing by 2.1%, rent can follow suit. Landlords should have no trouble filling vacancies with more than 35 leads per property – don’t miss out on making your investment dreams come true in La La land.

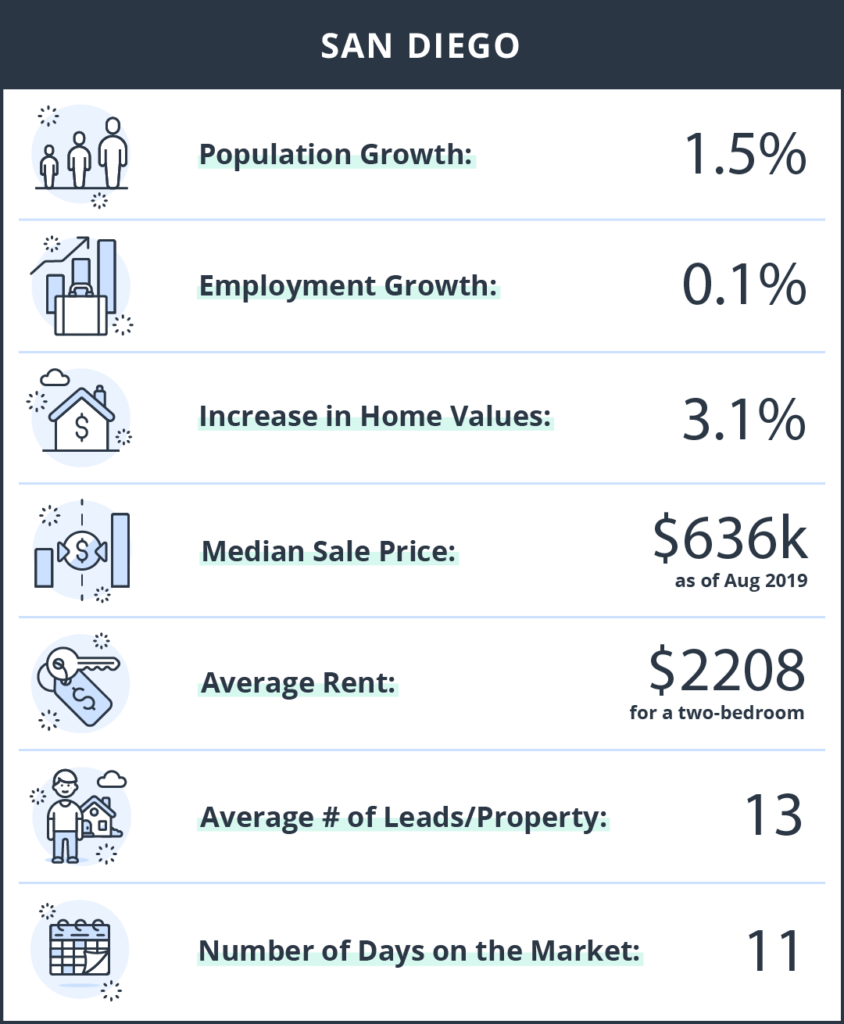

San Diego – home to Legoland, the seals of La Jolla, amazing food, Balboa Park, and the world-famous San Diego Zoo. This town is not only a great vacation destination, but it’s also a great place to invest in property as it has a steady increase in home values and population growth. With a constant influx of students from San Diego State University, University of San Diego, and the UC San Diego, rentals are a necessity for the thriving and diverse college population. Not only will rentals be necessary for students, but also for thousands of workers in tourism, military, and biotechnology. Landlords can easily expect to fill their properties in 11 days or less from a solid amount of leads – West Coast is the best coast as the locals say.

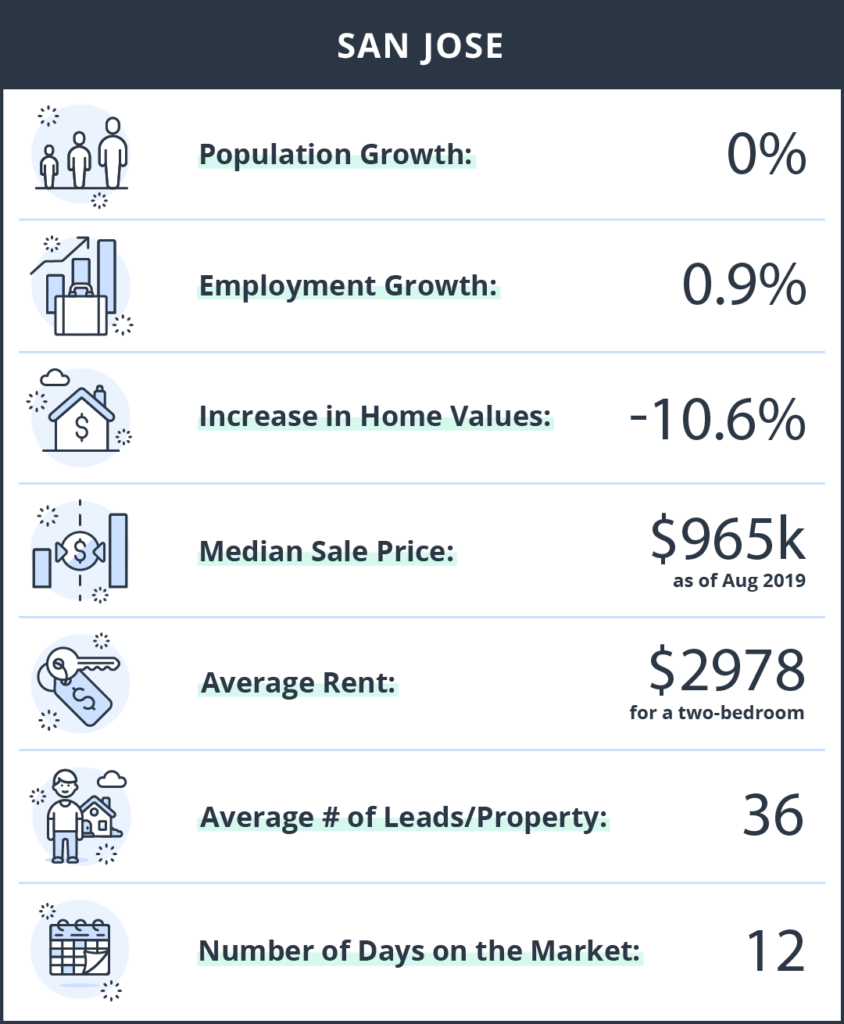

Home to Silicon Valley, in San Jose you’ll find booming tech industries, including close proximity to the Apple and Google headquarters. San Jose has a great downtown and metro area but also has many suburban neighborhoods perfect to invest in. Employment growth is steady in this town and locals can enjoy many amenities in the community such as the Santa Cruz Mountains, the ocean, year-round sunny weather, and many vineyards. San Jose State University, Stanford University, and Santa Clara attract students from all-over in need of rentals which is why there is a high average number of leads and a lower number of days on the rental market.

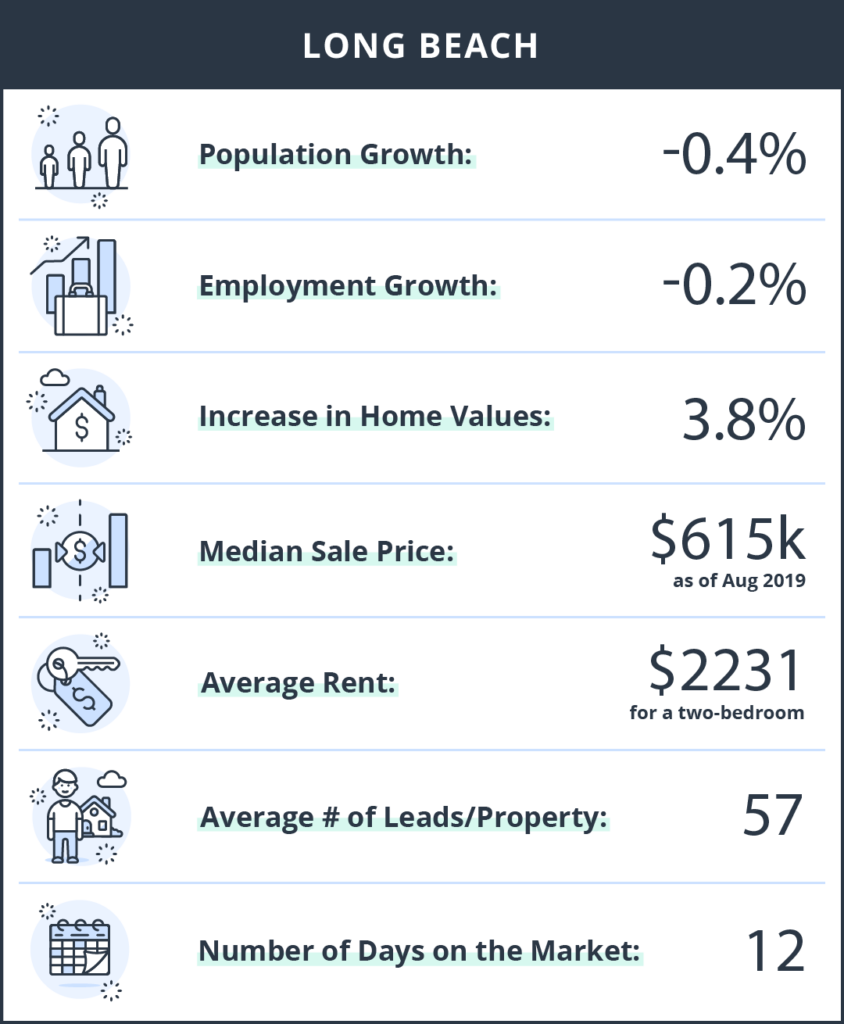

The Urban Waterfront Playground, AKA Long Beach, has it all. It is one of America’s most walkable cities focused on sustainability, diversity, and fun. Long Beach harbors eight different neighborhoods near the waterfront and is close to Catalina Island and Disneyland, while also being a prime spot for whale watching, shopping, and art. Rental properties are thriving in Long Beach as renters include a wide variety of people including multi-generational families, college students, and young singles. Long Beach is much more affordable to rent compared to other parts of Southern California meaning landlords won’t have a problem attracting renters to their property with an average of 57 leads per property and less than two weeks on the market.

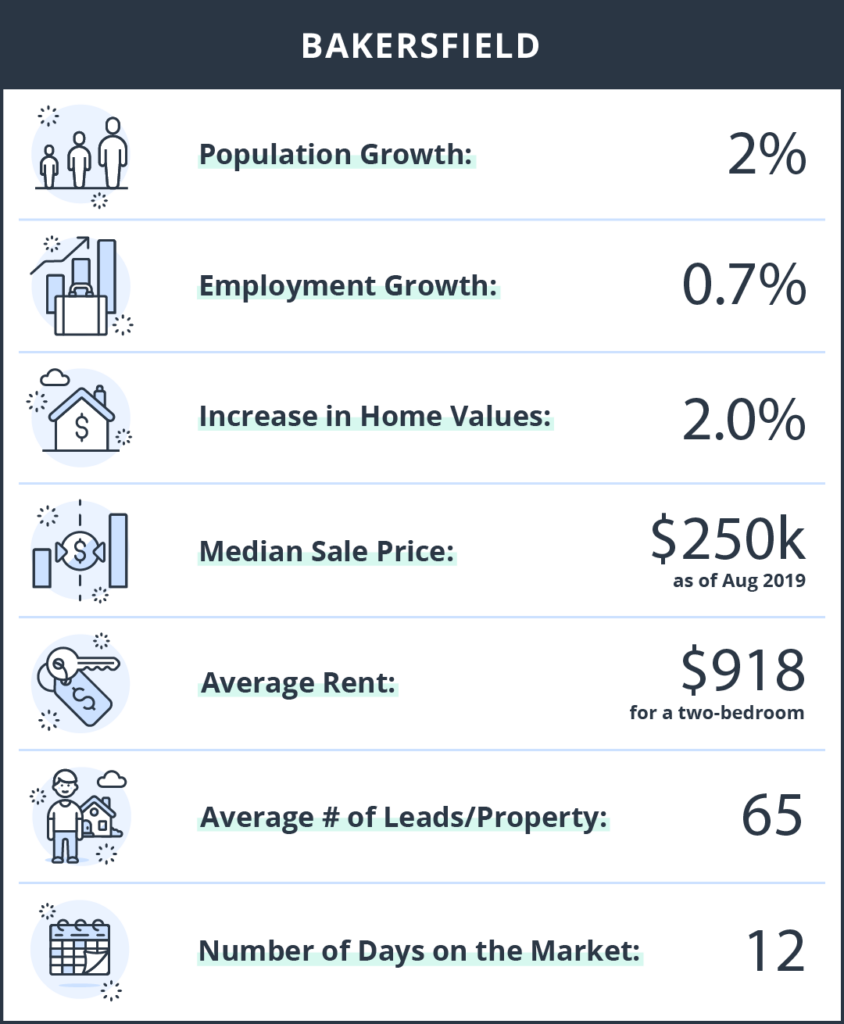

Bakersfield is known as the country music capital of the West Coast in the southern Central Valley of California – many compare it to Texas, with music and oil rigs being popular. However, don’t be mistaken – Bakersfield has its own great culture perfect for families – its metro area in the San Joaquin Valley provides fresh, and locally sourced foods, and the town is a short drive to California’s national parks. This town is a hidden gem for both renters and property investors – with an increase in population, employment, and home values, landlords receive an average of 65 leads per property as renters are attracted by the extremely reasonable average rent of only $918! While everything might be bigger in Texas, residents would argue everything is better in Bakersfield.

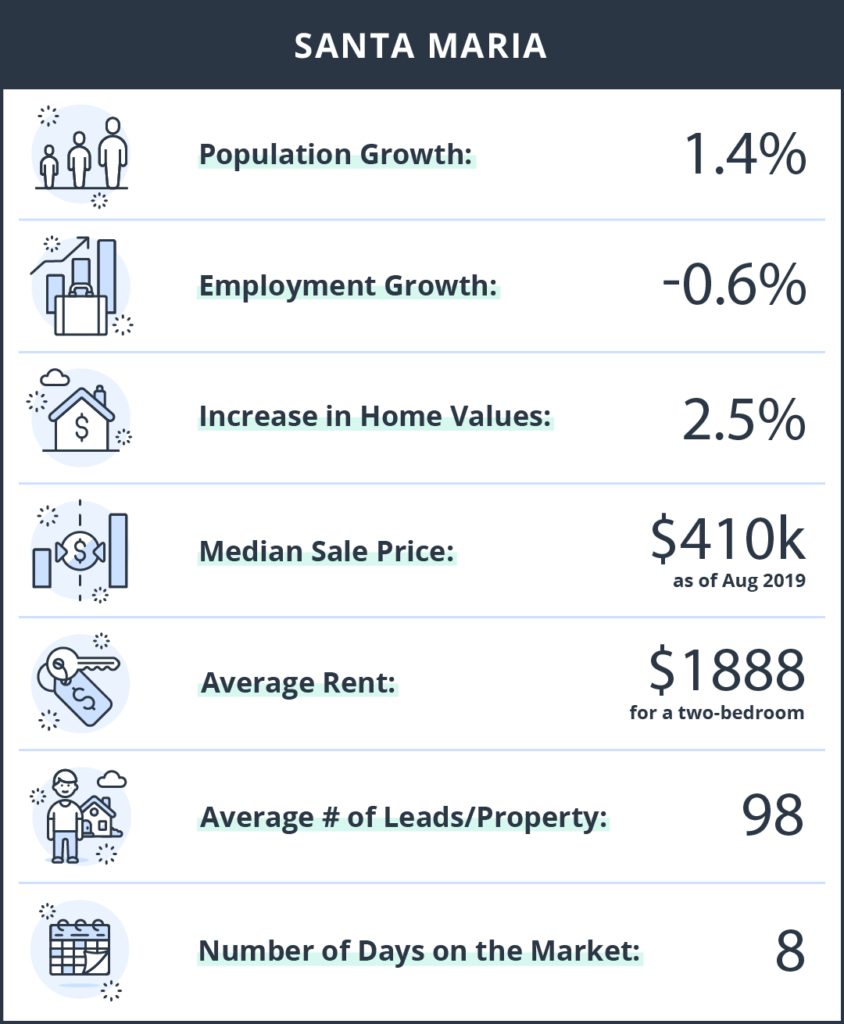

If you haven’t heard about Santa Maria, it’s time to jump on board. Wine and Santa Maria go hand in hand with its vineyards being one of its most attractive features along with multiple parks, trails, outdoor activities, galleries, and its renowned barbecue. Its great family-oriented community has an affordable average rent of $1,888 compared to its neighboring Santa Barbara. Agriculture, government, and many business owners make up the economy for this small, but unique town in Santa Barbara County. Property investors will see extreme success in Santa Maria as it claims not only the highest leads per property out of all of the California towns, but also the lowest number of days on the rental market – landlords can sit back and relax with a glass of Santa Maria wine when they invest here.

Once you’ve landed the perfect investment property in a good location, TurboTenant can help take your landlording into the digital world by streamlining the rental process with easy and free online rental applications as well as thorough tenant screening so you can find the best renter for your property.

Use our handy map tool to explore top rental markets throughout the U.S.

Use our handy map tool to explore top rental markets throughout the U.S.

The TurboTenant Report analyzes data from active listings across all 50 states, as well as third party real estate, population and employment growth data. Our goal with the TurboReport is to empower seasoned and novice investors to make wise purchasing decisions when purchasing a rental investment property. For more information or custom data requests, please contact [email protected].

In order to determine the best cities to invest in each state, we curated data from a number of reputable sources as well as using TurboTenant proprietary data. Our main city selections were taken from a study that evaluated four main factors for each city: employment growth, population growth, increase in home values and rental yield. We combined that with TurboTenant data on the average rent price, the number of rental leads per property, as well as the average number of days the rental stays on the market.

We also included an honorable mention where applicable. They are pulled from this study on the best places to invest in every state. These were determined using Zillow’s Buyer-Seller Index and Zillow Home Value Forecast, and AreaVibes’ Livability Score. Other methods for determining honorable mentions include using TurboTenant proprietary data to determine which cities return the best rental investment R.O.I. using data points including days on market, the number of leads per property, and average rent price.

DISCLAIMER: TurboTenant, Inc does not provide legal advice. This material has been prepared for informational purposes only. All users are advised to check all applicable local, state and federal laws and consult legal counsel should questions arise.

4 min read

And then you realize that the people are your source that you’re learning from. And the people keep you in company and...

5 min read

We have this really good integration. We make them feel like they are part of the company....but it’s like we also make...

4 min read

Well, I guess the thing that pops into my mind right now is you have a lot of freedom to do things...

Join the 700,000+ independent landlords who rely on TurboTenant to create welcoming rental experiences.

No tricks or trials to worry about. So what’s the harm? Try it today!