According to Investopedia, a rent-controlled apartment is part of a government program that limits the amount that a landlord can raise the rent. Though these programs are executed by local municipalities and vary accordingly, most tenants who maintain occupancy in a rent-controlled apartment either inherited that unit from a family member or have lived there since the early to mid-1970s. Unsurprisingly, most tenants love being a part of a rent control program while landlords face unique challenges with these units since they must stay up to date on all related regulations to avoid breaking local and state laws.

This guide will help you understand how rent control works, who makes the rules, and the pros and cons of this type of investment.

How Does Rent Control Work?

Rent control works by having a government body set rules about how much rent can be raised in a given year for qualifying properties. Per Forbes, there are three types of rent control:

- No rent increases are allowed

- Rental rates are regulated between tenancies

- Limits are placed on rental rate increases

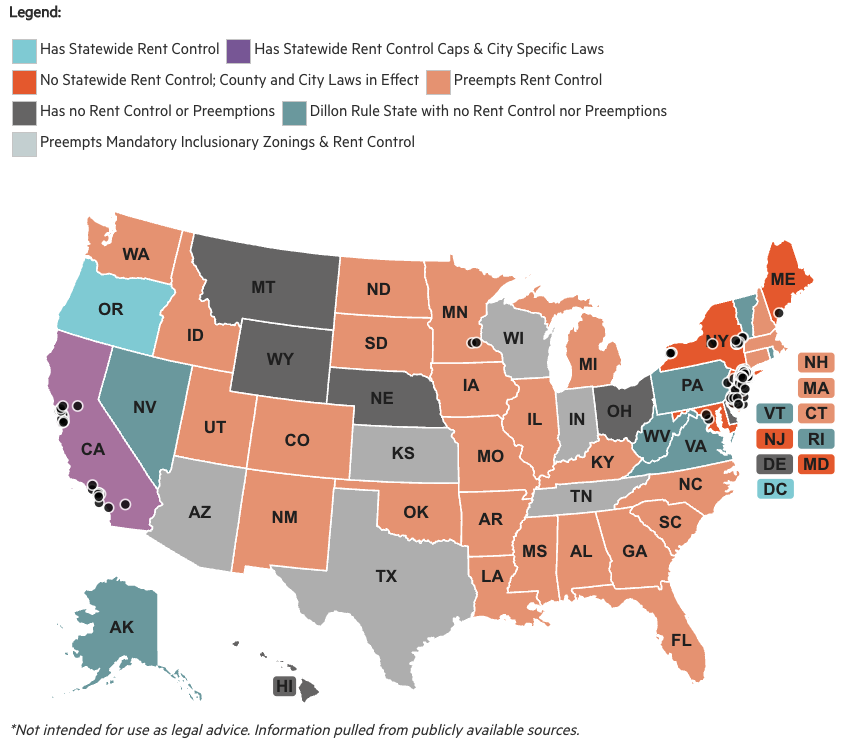

Typically, rent control is regulated by the state, though sometimes individual cities lead the charge. 37 states ban rent control outright, but 182 municipalities across the U.S. have rent-regulation rules – all of which are located in six places.

The six states and cities with existing rent-regulation programs include:

- New York State

- Newark, New Jersey

- California

- Oregon

- Washington, D.C

- Takoma, Maryland

Before we dive into an overview of the rent control programs for each of the locations listed above, it’s important to note that each program outlines specific exemptions. In many states, newer units aren’t required to be rent-controlled. Additionally, if the property owner provides capital improvements to older properties, they may be exempt from the rent control program. With that in mind, let’s examine the various existing programs across the U.S.:

- The New York City Rent Guidelines Board establishes a maximum base rent, just above landlord costs, that the annual rent cannot exceed. The program works similarly at the state level. However, there are specific requirements that the property (and tenants) must meet in order to qualify for this program. For an apartment to be considered rent-controlled, it must have been built before 1943 and occupied by the same tenant (or an inheritor) before 1971. To inherit this kind of unit, the heir must have lived in the rent-controlled apartment for at least two years with the previous tenant before their demise. With these kinds of rules in place, it’s no surprise that only 1% of NYC apartments are rent-controlled.

- Newark, New Jersey, also has rent control laws limiting rent increases. Per the city of Newark’s municipal code, “no landlord may request or receive an increase greater than the percentage increase in the Consumer Price Index (CPI) from the CPI 15 months prior to the month of the proposed rent increase to the CPI three months prior to the month of the proposed rent increase. In no case shall the allowable rent increase exceed 4%.”

- Los Angeles and San Francisco have existing rent control laws, and the entire state of California enacted rent control regulation in 2020 that limited rent increases on qualifying units to no more than 5% plus the increase in the CPI or 10% of the lowest rent charged at any time during the year prior to the increase – whichever is less.

- In Oregon, a recent law restricts landlords from enacting any rent increase for existing tenants over 7% plus inflation as defined by the consumer price index. While the rest of the states on this list offer some form of rent control, it‘s worth noting that Oregon provides the only statewide rent control.

- In Washington, D.C., ”the most common allowable increase in rent is an annual adjustment, based on the increase in the Consumer Price Index. For most tenants, the most that their rent can increase is the CPI percentage plus 2%, but not more than 10%,” according to the D.C. Department of Housing and Community Development. Rent control applies to rental housing built before 1975, but excludes units that were vacant when the act took place and housing owned by a person who owns more than four rental units.

- Takoma, Maryland, offers a rent stabilization program, which was adopted in 1981 and continues to be one of the city’s primary affordable housing programs. Beginning July 1, 2022 through June 30, 2023, the Rent Stabilization Allowance is 7.3%. According to the city’s website, “[Takoma]’s rent stabilization law applies to all individual condos and multi-family rental facilities. [The] rent stabilization law DOES NOT apply to single-family houses, accessory apartments, and duplexes when one of the units is occupied by the owner as their primary residence.”

What’s the Difference Between Rent Control and Rent Stabilization?

Per Investopedia, rent control tends to be more aggressive while rent stabilization focuses on more modest restraints. Rent stabilization is more common than rent control, particularly in places like New York. In fact, ”the 2021 NYC Housing and Vacancy Survey found that there were 16,400 rent-controlled apartments, compared to 1,048,860 rent-stabilized apartments in the city in that year. The authors of the Urban Institute study attribute this partly to provisions that require continuous occupancy and vacancy control in New York City.”

Who’s in Charge of Setting Rent Control Prices?

The market rate for rent-controlled and rent-stabilized apartments is typically determined by a rent guidelines board. NYC, New York State, and San Francisco have such a board to provide adaptive affordable housing.

In D.C., Takoma, and California, rent control is defined by state agencies as a pre-determined percentage and inflation according to the Consumer Price Index. The same is true in Newark, NJ. Oregon, as the only location with state-wide rent control, legislated its program through Senate Bill 608.

The Pros and Cons of Rent Control

Rent control is an issue that waxes and wanes in popularity as economic opinions change. The reason rent control programs existed in a few cities before 2019 is because it has primarily been implemented in places where rent can skyrocket above affordability for those who live and work in downtown areas. At the same time, rent control is not a reflection of the free market and limits landlords’ ability to profit from their real estate investments – which in turn discourages ownership and management of rent-controlled buildings.

Let’s look at the pros and cons of rent-controlled apartments.

The Advantages of Rent Control

Renters enjoy:

- Guaranteed affordable housing

- The ability to budget for housing costs years in advance

- The ability to pass affordable housing to an heir in some cases

- Having additional protections against eviction

- The ability to pay fairer rates for older properties

Landlords enjoy:

- Having a predictable budget (no need to re-calculate each year)

- Long-term tenants who typically pay on time

- Having a stabilizing asset in their portfolio

- High demand for rent-controlled and stabilized apartments in all applicable rental markets

- Low competition with other landlords to buy rent-controlled properties

The Disadvantages of Rent Control

Renters may dislike:

- Being unable to move without disqualifying the unit from the rent control program

- Living in older units that are more difficult to keep well-repaired

- A lack of newer, competitive amenities

Landlords may dislike:

- Being unable to charge market rent

- Being unable to evict tenants for renovations

- Having to raise rent at every permissible interval or risk falling behind

- Having to rustle up funds for maintenance, amenities, and emergencies

Are you considering purchasing an apartment building with rent-controlled units? If so, just remember that rent-controlled units present a unique business model and one that should be considered carefully based on your local laws and policies.