Perfect Your Rental Property Management System Webinar

In this webinar, hosts Krista Reuther and Samantha Yadav offer guidance to independent landlords on how to build and manage a successful rental business, focusing on team assembly and operational efficiency.

Key Takeaways

- Weaknesses and Goals: Identify personal weaknesses and set clear goals for your rental business.

- Define Processes: Establish standard processes to streamline your operations and improve efficiency.

- Building a Team: Tips on assembling a team that complements your skills and helps alleviate your workload.

- Tracking and Analytics: Emphasis on the importance of tracking analytics for property management and making informed decisions based on data.

- Handling Tasks That Drain You: Encouragement to delegate or outsource tasks that are overwhelming or outside your skill set.

- Advice on when to consult with real estate attorneys and the importance of having one for more complex legal matters.

- Discussion on financial planning specifically tailored for landlords, including the setting of long-term financial goals.

- Overview of options for transferring property ownership, such as wills and living trusts, and the implications of each.

Transcript ▼

Krista Reuther:

Hello, hello. I am so thrilled to see all of you. I’m going to turn it over to my brilliant co-host, Samantha. Now, Samantha is our Landlord Experience Specialist.

Samantha Yadav:

Yes, let’s jump into what we’re going to talk about today. So the first thing, as you can see here, we’re calling out, being an independent landlord does not mean that you have to do everything alone. So we’re going to help you with assembling your A team in three steps. We’re first going to examine the weaknesses and goals that you may have for your rental business. We’re also going to define processes. And then finally, we’re going to segue to finding your people and building that A team to help you successfully manage your rental business. Absolutely.

Krista Reuther:

Couldn’t have said it better myself. So let’s start with the foundation here. And of course, your foundation is going to require some reflection. Whether you’ve been in the game for ages, or you’re just starting out, you haven’t purchased your property yet. I think something that often gets overlooked when you’re trying to build a lasting investment portfolio is really the need to be tracking analytics, reflecting on your progress and making sure that you’re on a roadmap to where you want to get to. So with that, we’re going to start with your goals and your weaknesses. Because as uncomfortable as it can be to examine those spots, you will often find that there is help out there to take some of those burdens off of your plate and make your goals that much more accessible.

So let’s start with arguably the less fun thing, which is our weaknesses, right? Of course, there are so many different steps of property management, so many different distances between you and the tenants. All of that is going to factor into what fills your cup as a property owner and what drains you. Forcing yourself to handle tasks that drain you is going to kind of, it can definitely lead you to burning out or otherwise not maximizing your efforts because you’re getting bogged down in details that are costing you more than they pay off, right? So with that in mind, if you’re not sure where those weaknesses lie, I would ask the following questions of myself. Consider which tasks you put off doing that you kind of procrastinate. Also, why are you procrastinating on those tasks? Is it because they feel overwhelming?

Is it because you’re not confident in your ability to fulfill the task to its full scope? What is going on that you are avoiding whichever areas of property management you are currently pushing to the side, right? With that in mind, do those pieces come into play when you’re considering what’s holding you back from where you want your portfolio to be?

And we’ll talk about some of the places where you might want your portfolio to be or some overarching goals that you might have, but this is where we’re going to start off, okay? Once you start asking yourself those questions, I am a really huge fan of pen and paper, getting down to business, really going a manual route. So with that in mind, if you have a piece of paper on you or later when you’re watching this back, if you would like to go through this exercise, I would recommend grabbing a piece of paper and piding it into thirds. Then you’re going to go ahead and label the columns with problem to solve, who can help, excuse me, and what will the solution cost? Basically, I really want you to identify line by line the various things that are getting in your way and starting to do some pre-planning to understand where they might fall in terms of your plan moving forward. If there’s something that really gets in your way, let’s say expense tracking, for example, that’s something that you need to be doing on a regular basis, and so that’s going to get in your way more significantly than, let’s say, struggling to take good listing photos, right? Two different issues, two different areas of the landlord journey, but each is going to impact you differently, and it’s going to hit your bottom line in a different way, because you could get in serious legal trouble if you’re tracking your expenses incorrectly, whereas you’re probably not going to get arrested if you take bad real estate pictures, right?

So as you read through this list, make sure that you are assigning a priority rating to each of the issues that pop up for you. If you don’t have a pen and paper, we did make a little version of this so that you can follow along either now or later. Samantha and Jonathan, if you haven’t dropped it in the chat, if you could, that would be lovely.

I cannot see because I have a fancy new ring light, so either way, whether you’re using old school paper or this digital version, making sure that you’re outlining your thoughts is going to help you create this plan of action and prioritize your next steps. So with that in mind, if you’re willing to share in the chat, Samantha, we have a question.

Samantha Yadav:

We do have a question. So we want to know what’s the biggest barrier in your way? What is something that you put off doing or is just really causing you a struggle in your rental business that you want to focus on improving and doing better on in the future? Absolutely.

Krista Reuther:

Now, if you don’t know, Samantha has some extensive background in property management. So Samantha, I’m curious if you have any thoughts about what could get in people’s way when they’re trying to build up their portfolio or otherwise manage the day-to-day grind of property management.

Samantha Yadav:

Yeah, I think a lot of it, especially as you’re kind of getting into rental management, if you’re maybe a newer landlord or you’re just sort of figuring things out, it’s just going to be the documentation piece and keeping records of everything. So having these established processes and systems in place to help you not just start off on the right foot, but stay on the path and stay organized, I think is going to be a big hurdle. Of course, you can use software like TurboTenant to help you stay organized.

For me, one of the big challenges that I had was actually sort of related to expenses, but it was more so I managed multi-family rentals between 250 and 1500 rentals. So there would be a time where I would be, let’s say, scheduling multiple cleanings or carpet cleanings or carpet replacements or paintings or things like that, and I may schedule them on Tuesday for work the next week, and then the invoice doesn’t come for 30 days later, right? And so when that invoice comes, if my contractor didn’t have very specific line items in my invoice, I would struggle to remember where everything went. So for me, I started a purchase order process, which is just when I’m initiating that order, I’m writing it down, I’m taking a track of it, who the contractor is, how much I’m agreeing to pay, things of that nature, and then I can link that invoice directly to that purchase order. So I found that to be a solution for me and a process that worked for me to help me stay organized and track those sort of big items when I’m planning a lot of things in advance.

Krista Reuther:

Absolutely, that’s a fantastic answer, and I love how you mentioned the process you undertook and the information you recorded. We’re going to get into some key processes here shortly, but I’m curious if there’s anything popping up in the chat.

Samantha Yadav:

Yeah, so it looks like we’ve got expense tracking, expense tracking onboarding a new property, rent increases, tracking hours for real estate investments for tax purposes, getting rid of the bad tenants with evictions, minor repairs, finding new vendors and handy people, automated collections and reports, finding good contractors, quality contractors, finding great tenants, reasonably priced vendors.

Krista Reuther:

These are all really important issues that you bring up, and thank you for sharing them, because like I said, it’s not exactly fun to look at your own weaknesses and establish, especially in a public setting, what those could be. But admitting that there is something you could work on or you need help with is the first step to actually getting it resolved. Also, as I mentioned, Samantha has a wealth of experience in this realm. She loaned me her very thick property management book for, let’s see, the Certified Apartment Manager program. So I was referencing this as we, as I went through and researched the presentation, there’s so much to learn. That’s why we’re saying, don’t feel like you have to take on everything at once.

We’re of course always here to be a resource for you and we’ll go through this presentation and help you understand other spots where you can bring people in and establish processes that take some of those problems off of your back and barriers out of your way so you can do what you want to do. With that in mind, let’s think about something a little bit more fun, specifically your goals. So once again, I love a tactile piece of paper and a pen, but don’t feel pressured when you go through and do this exercise. I similarly want you to have three columns at least to track the goal you want to achieve and make it as specific as possible. Maybe you want to make sure that you have three to six months’ expenses saved or you want to acquire more property, maybe acquire five more pieces of property by 2030.

Or maybe it’s something like retiring from your full-time job. There are so many different reasons why people have their investment portfolios and it’s really important for you to hone in on what is driving you to do this. Because having that goal in sight, one, it’s a great motivator. And two, it can help you in times get tough so that you can understand where it’s best to pivot and where it’s best to bring in help or otherwise change the situation so you can continue tracking towards your goals. As you move through and ask yourself the goal where you could use help and who could be that help for you, again, prioritize what’s going on. I would recommend looking at the goals that have the highest return on interest, highest ROI for you, and the lowest cost to achieve. That might be a great place to start. Alternatively, if you want to go with the highest cost to achieve and make that really a pinnacle that you are working toward as you grind away at your goals, awesome, wonderful. Just be sure you’re orienting yourself to something that compels you specifically. It’s going to be different from that landlord to landlord. But I am curious. What is your biggest opportunity or goal?

Samantha Yadav:

Yeah, we would love to see it in the chat what you think your biggest opportunity or goal is. And that can be for the rest of this year. That can be for next year. It can be a five-year goal. Something to keep in mind is we love seeing goals that are measurable and actionable.

So if you have a specific dollar amount or a specific number of properties by a specific date, that’s going to help you not only set you up for success, but also help you to check in and see how you’re doing with your goals, how you’re progressing.

Krista Reuther:

Absolutely. And while we get some answers in the chat, Samantha, once again, I’m going to pick on you. Back when you were working in multifamily property management, I’m sure that you had a lot of competing goals at any given time. How did you prioritize which one to focus on?

Samantha Yadav:

Yeah, so I would say the biggest priority in my multifamily space was just hitting our occupancy goals. So we had different occupancy goals every week and that occupancy would range from 94% to 96%. If our occupancy ever exceeded 96%, that was a cue to me as the asset manager there that maybe prices should go up. Maybe we should be more competitive with our rates. Now, again, keep in mind that my rentals, I had 250 to 1500 at a time.

So that’s a lot of rentals to manage at one time. But some of the other goals that we would have are reducing the expenses for the following year. So you would review your contracts for this year, maybe talk to vendors that you worked with previously and say, listen, I have a goal of reducing my expenses by X amount for next year. Let’s review this contract. And you may not get a huge change to your contract. But if you have a few contracts you’re able to make minor adjustments to that can add up in the course of a year. So looking at those goals, looking at how you can meet them and then also taking the actions to get there. Absolutely.

We do have some answers here in the chat. So Jene wants to build a retirement portfolio in the next three years, at least one or two more properties. Love that. Tamara wants to add another rental properties portfolio by June 2024.

Love to see dates in there. Acquire 10 more properties in two years. Get vacant apartments renovated and rent ready. Find third property by the end of this year. Hope to have enough to retire in one to two years. Nice. Have my furnished four bedroom three bath townhouse rented out more continuously.

Krista Reuther:

Love that. Exactly as Samantha was highlighting, having strong numbers and actual figures in your goal makes it that much more achievable. When you quantify it you can start to unpack the steps you need to take in order to get to that number. So thank you for sharing. Love to hear all of those. Those seem very achievable. So I will be keeping my fingers crossed for you.

But even better than that I’m going to help you do it. Mostly by making sure that you have defined processes in place. So one of the reasons that having defined processes is so important beyond the fact that it streamlines your business, which here is meaning that you get so used to doing things in a particular way that it takes you less time each time you engage in that action. The other reason it’s important is for the legal side of things. So specifically let’s talk about fair housing for a second. If you’ve defined your tenant screening requirements and you have that written out and you get accused of a fair housing violation by a potential applicant, you then have documentation to go back and say this is the set criteria that I use every time when I’m screening tenants and you can go buy the book and make sure that you are not violating any of the Fair Housing Act by having everything that you’re doing written out clear, good to go. So it’s really something that protects you if you use it correctly and keep good documentation. Defined processes and good documentation are your best friends as a landlord so anywhere where you can put things down in writing where you have it committed to a space, even if you’ve been doing it forever and it all lives up in your head, I would really encourage you to put it down and define it, particularly if you’re looking to pass on your legacy and you want, let’s say, your children to take over your rentals.

That’ll give them a huge leg up when they go to embark on their own property management journey. Even if you’re not doing that, even if you’re not having children, whatever, still make sure that you’re defining your processes because that also gives you space to examine what you’ve been doing over the course of a year and make tweaks so that you get better and better over time. If you’re sitting here and you’re like, Christa, what is a process? Why do you keep saying processes?

Well, do not fear. In this context, it’s really just a series of actions that you’re taking in order to get something done and a good process is going to make sure that you’re maximizing your effectiveness for minimal long-term effort. So you’re going to have to set something up from the get-go.

You have to put in the effort in the front end, but then over time, that should significantly decrease and become something that’s faster and faster for you. So let’s take a look with some examples. And these are real things that we’ve heard from landlords. So let’s just pe in. What do you think takes more time? Writing a fresh lease for every new tenant or leveraging a template and making adjustments for new tenants as needed?

Samantha Yadav:

I have a guess. Do you? Let’s go. Probably using the template.

Krista Reuther:

That takes less time. Yes. Oh, that was the question you asked. Perfect. Brilliant. But you’re right. Even though there’s going to be time to set up the template, make sure that it’s good for everything you need. It has your specific parking information, utility breakdown, et cetera. If you do that once, you can then repeat that action with less effort moving forward. Okay. Another example. Basing your tenant selection on gut feeling versus outlining your minimum requirements and reusing that list. What do we think takes more time? I know.

Samantha Yadav:

I think a guess. It’s going to take more time to base tenant selection on gut feeling. Yes.

Krista Reuther:

Ding, ding, ding. You are a genius. And even though that might not sound right from the jump, I promise you that if you get caught up in a fair housing case, it’s definitely going to take more of your time because you decided to align your gut feelings versus having cleanly outlined minimum requirements that align with the act itself. So make sure that you have things documented.

Having things documented is going to be good for you. Okay. Very last one. I know this is a silly game.

The answers are evident, but let’s play. What takes more time? Letting your tenants pay rent through a different method every month or setting expectations early about acceptable rent payment methods and collecting it thereafter?

Samantha Yadav:

This is a really tricky one, Krista, because I could wait for my rent checks to come in the mail or I could have my tenants bringing me physical payments on their schedule when works for them. I’m guessing that that’s going to take more time than streamlining the process and doing it online with something maybe like TurboTenant.

Krista Reuther:

Oh my gosh. Someone get this woman a crown. She has won this game. Yes. So if you take the time to set your expectations about which rent methods you’re going to accept, then you can just collect it every month. If you really want to streamline it, we do have an online rent collection service here at TurboTenant.

Jonathan, if you’re out there in the ether, please drop a link for the people just in case you need it. But really, again, putting the effort in at the very front of a task and making sure it’s something repeatable and easy to access will help you move faster and faster as you get more doors or make sure that you’re fully furnished for bedroom is ready to roll. Anything that you’re doing will get faster if you have these defined processes in place. But there’s a lot that goes into all of these processes because, again, there’s a lot on your plate as a landlord. So let’s go over some of the most common rental management processes that you need. We’ll also then jump into some more specific ones that are based on goals we hear from landlords most often, starting us off. Of course, nobody wants to have an empty rental unit, or at least that’s generally not ideal. So you need to fill it. But filling it really takes a lot of steps, right?

So we’re breaking this down. You need to market your vacancy, which means writing the listing, taking the pictures, researching rent in your neighborhood, posting your listing on and offline. Then the applicants start coming in.

Well, you need to create a rental application. You should screen folks. Make sure you’re running their credit criminal and eviction history check. You then probably want to meet them in some way, whether that’s face to face or over Zoom, would recommend meeting them before they move into your property, if at all possible. Then of course, you need to create a lease and collect tenant signatures, move in costs, etc. That’s a lot and they haven’t even started living there yet. So then of course, you do have to have them live there.

That’s how they pay rent. Once they are in, you are managing the tenant, which means you are going to need to be accessible for all kinds of issues, whether that’s maintenance issues, emergency situations, if there’s just general property questions, maybe they want to put in an above ground pool and they want your permission. You should be accessible for them to ask those kinds of questions.

Otherwise, you can end up in a sticky situation. You’ll also need to do most landlords favorite part of this job, which is collecting rent. So you’ll have to establish a channel through which you are willing to collect rent. Of course, keeping up on late fees is important and you want to make sure that you’re maintaining a time-stamped record of charges and payments. This will help you keep all of your expenses above water. We also have some resources later on to help with that.

But really, the biggest trick is just to make sure that you understand where your money is going and where it’s coming in from with time-stamped information attached. You’ll also want to go ahead and conduct regular inspections. So this is one of the biggest pieces of advice that we give, mostly because regular inspections serve so many different purposes. They help you maintain a relationship with your tenants and they also give you the opportunity to point out issues before they snowball into something bigger. On the tenant side, they might appreciate it because if you can point something out before it dings them on their move out and it reduces their security deposit, that feels good.

They have a chance to actually fix things. Plus, you can know that your property is in good hands. So make sure that you are documenting any inspection findings, walking through with the tenant if possible, and otherwise just getting in there, I would say at least once a quarter, once every six months would be my maximum time between inspections. But whatever works for you and your properties, as long as you’re doing it regularly and for everyone.

Okay. And you’re still not done because part of being a DIY landlord or an independent landlord is making sure that you’re actually making money. So you have to watch your bottom line. That means tracking your expenses. So capturing your receipts, inputting charges and payments, as we mentioned, especially with time-stamped information, that’ll be crucial if any legal issues pop up. And of course, monitoring your net operating income or NOI. If you need help tracking your expenses, I’ve linked out here.

We will go ahead and send this out to you. But we do have a free spreadsheet where you can track your expenses. Alternatively, we do offer expense tracking in our platform directly. If you want to go all the way, you can also leverage our integration with REI Hub.

It is a paid service, but we offer plenty of free options as well, depending on where needs. In addition to all of the expense tracking, you’re also going to have to make sure that you are maintaining your financial obligations. So that means paying for your insurance policy, paying property taxes, paying contractor fees or utilities as needed. Maybe you have an HOA that you’re a part of. You will also likely need to pay for any costs that pop up regarding maintenance, depending on what that is, what the breakdown is in your lease, etc. So if you have three to six months worth of expenses saved, you should be in a healthy spot. If that isn’t something that you have currently available to you, I would highly, highly recommend that you make that one of your goals. All right.

Samantha Yadav:

We’ve got a poll. Check in with everybody. We want to know what processes you don’t have currently. So maybe you don’t have a process for marketing your rentals or for creating your lease agreement, screening your tenants, getting signatures on documents, rent collection maintenance, management document, storage expense tracking. We have it all listed here. And if there’s anything else that you don’t have a process for and you want to talk about or get into, certainly let us know in the chat.

Krista Reuther:

Absolutely. Now, it sounds like you had to create a process for order management. Are there any other processes that came to mind when you think about what you didn’t have despite learning from this giant book?

Samantha Yadav:

Yeah. So I’m in a bit of a unique situation in that I did have a ton of resources available to me. Again, big multifamily. So I did a lot of things through the National Department Association and my local groups. And it is multifamily. So a lot of things were already established by the company, right? Through the multifamily management company. With that in mind, when COVID hit, we had to revamp all of our processes because we couldn’t tour in person.

We had to clean every apartment in between tours. We had to figure out a way to have a personal human connection with somebody without actually seeing them in person. So we had to sort of reevaluate what that looked like for us, figure out how we can incorporate, you know, like FaceTime and virtual tours while they’re in my building, in my rentals, but I can’t be with them.

What are some frequently asked questions that they’re going to have that I can have a sheet right in the apartment for them to kind of mitigate that because I know the questions are going to come up, but are they going to be comfortable asking me via text or FaceTime as opposed to just in person when we’re having a conversation? So that’s definitely one process that we had to reimagine during COVID for sure.

Krista Reuther:

Shdis, yeah, and pretty quickly too, I imagine, like on the fly. Man, crazy times, right? Unprecedented, you might say. So looking at this poll here, it’s pretty interesting. It looks like across the board there’s some definite needs for different processes. What’s standing out is a desire to find new investment properties, maintenance management, and expense tracking. Very interesting stuff. I don’t want to pull back the curtain too far, but I will say that our engineers and developers have been looking at ways to help with maintenance management more than we already do because you can have your tenant send maintenance requests through TurboTenant, but we will touch on that later. Anything else on this point before we scooch along, Samantha?

Samantha Yadav:

Yeah, I just see that there’s a couple of comments in the chat. The security deposit process and ESA pet process. We do have a whole other webinar about emotional support animals with a ton of resources and guidance for Landlord. So if you’re looking for more information on that process, you can go to TurboTenant.com slash webinars to find all of our things. And we have a YouTube channel.

And if you’re not subscribed, you should be because there’s a lot of great resources in there. And then Erica also asked, where can they buy the book? That is actually part of the National Apartment Association Certified Apartment Manager designation credential course. So I don’t believe that you can buy just the book.

I do think that you have to purchase and enroll in the whole course. But what’s cool about that is that it’s all in my brain and I’ve been sharing it with Krista. And we share it with you all in our blogs and our webinars and our TurboTox and all of the things that we have. So any questions you have, we probably touched on it at some point. Just keep them coming.

Krista Reuther:

Absolutely. Beautiful, beautiful. Also, I will say we have a webinar on security deposits as well. So if you want to check that out, please do because that is definitely important and we want to make sure you know what to do. In the meantime, let’s go ahead and touch on some specific task lists depending on different goals that you might have.

So we’re going to go broad here because I have to, unfortunately. With so many folks in the chat, it’s hard to get super specific, but this should at least give you a jumping off point for your goals. So if you are looking to expand your portfolio, of course, the first thing you want to do if you haven’t already defined your buy box.

So that means defining what you want in a property, what you must have, what you’d like to have, what would be fine, but you don’t really care about what you cannot have. Do all of that. Write it out.

Be specific. You could then go and work with either a real estate agent in your area or just start researching your own local markets, whatever you want to do. But then you have a set of criteria that you can use to evaluate different properties and see if they align with your needs. Once you have a good feel for what you’re looking for and you have those relationships that you need in order to find a property, you can go ahead and be ready to purchase. In order to do that, you’re going to want to communicate with your lender or investment partners beforehand.

So if I was you, I would define my buy box. I would talk to my investment partner if I had one or my lender if I didn’t. And then I would continue researching and monitoring my desired market until properties popped up and then move forward with my real estate agent. Alternatively, I might bring my agent in earlier if they have specific rental experience.

That is fantastic. That’s the agent for you. Work with them and figure out what is good on your street slash in the neighborhood that you’d like.

Additionally, if you’re looking to expand, you cannot underestimate the importance of a positive landlord-tenant relationship. Why? Well, one, it’s pleasant. But two, it’s good business sense because you can establish such a rapport with your tenants that they start referring people to you. And then if you want to take it an extra step, you can create a referral program to actually shorten your vacancy cycle. So that could look like, hey, if somebody, you know, if I refer my friend to a landlord, then, and they stay for six months, they have a six-month lease, maybe the landlord will give me a free hat or something of that nature, right?

Maybe it’s a $25 gift card to Chili’s. Pretty easy to please. But you can establish something that’s, again, repeatable and documented to help encourage others to spread the word about your business because that is free marketing and you can’t go wrong with free marketing. Lastly here, of course, and this is a tip for everyone. Always stay up to date on your local landlord-tenant loss. Okay. That means monitoring your local legislation sessions.

Excuse me. You should also sign up for educational industry content, perhaps like a weekly newsletter, perhaps written by me. We do send that out every week.

Don’t feel pressured, but it is available. Sometimes has puns. And you’ll also want to join a landlord group. There is invaluable knowledge that gets passed around in these groups and also a good sense of camaraderie. We know that it can be lonely being a landlord because it’s not like you can be best friends with your tenants or at least it’s not advised.

So you sometimes just want to talk with people who understand what you’re going through, who maybe have similar goals to you and brainstorm and otherwise feel connected to community. That’s why joining a landlord group is important. Plus, they can let you know about deals potentially depending on the type of group and you could expand your portfolio based on insider knowledge from the group itself.

Samantha Yadav:

Speaking of landlord groups, I just dropped the link. We actually have our own Facebook group for landlords called Better Landlords and we have quite a few landlords in there talking about all kinds of topics. Today I think we talked about carpet replacement, there’s a post in there about pets, we’re chatting about things that our tenants love to say to us, all kinds of great conversations happening there, not just like struggles of landlording but also resources. If you’re looking for like kills recommendation for your floors or your walls, there’s a great one in that group and just all kinds of landlord interactions and communities it’s really fun to be a part of. So I dropped the link in the chat. If you join that group you will see me there a lot.

Krista Reuther:

Yeah and me sometimes but mostly Samantha which makes it all the better. Another thing you might be thinking of is pushing your business even higher. So how can you do that? You can do that by finding your niche. So your niche is going to be an area of specialization that you really hone in on and become an expert and doing that can unlock higher earning potential depending on your market and your specific niche. Specific niches might include stuff like midterm rentals or short term rentals if you want to go that route. Although make sure you know what Airbnb is doing in your city before you go that route just so you save yourself the heartache. I digress. What you’re going to want to do if you’re trying to find a niche is first consider your market and that doesn’t have to be the market that you’re currently investing in but it has to be one that you’d be comfortable investing in.

Really break it down and start to ask yourself what’s appealing about it. Is it a popular travel destination? Is it a business hub? Are there military bases? Is there a hospital nearby?

What would be drawing people to this area and what kind of housing need isn’t being filled accordingly? That’s where you could step in. Of course you’ll want to make sure that you’re requiring property that can serve that specific need once you have it defined. So don’t be afraid to branch out. If you’ve only ever done single family rentals, why not consider a multifamily rental? Especially if you have some years of experience that can be an easy way to persify your portfolio and start to branch out into a specific niche. Just make sure that it has the amenities that you think your target audience would want.

So let’s say you are targeting students specifically. Getting a multifamily property that’s close enough to campus or very close to public transit would be a huge boon. Business hubs specifically are another good thing to look for because they have an influx of short-term and mid-term renters. There are pros and cons of accepting short-term and mid-term rentals. We just recorded a video for you yesterday about mid-term rentals so that will be up on our YouTube channel when our wizard mic gets up there. But certainly within the next two weeks, so keep an eye out if you have questions there.

But really all of this is to say if you are looking to really expand your portfolio, not necessarily in terms of the number of units that you have, although that is part of it, but by expanding your expertise in an area, look at what’s around you and do your research, then jump in with both feet. That’d be my recommendation. And lastly, the goal that we’re going to go over, this is a really popular one we hear about it all the time, are the folks who are trying to build a legacy that they can pass on. So if that is what you’re looking to do, of course you really, really need to do your research here. We’re going to cover this in broad swaths, but every single person’s financial and investment situation is unique, so make sure that you’re consulting with an estate planning attorney specifically. However, here are some of the broad options that you will likely have available to you. So you could bequeath properties in your will. You could transfer properties to a living trust. You could gift the properties or sell the properties and then if you’re feeling really generous, give the money to your dependents. Of course, there are pros and cons with all of these different methods.

Let’s just pick out a couple of them. So if you are bequeathing rental properties in a will, good news is that’s usually simpler and less expensive than setting up a living trust. You can also maintain complete control over the properties during your lifetime, which is nice. So you don’t have to relinquish control. And you can make changes to your will at any time. So if I’m in your will and I really get under your skin, you could cut me out. And that would be your right. And then no properties for me.

Very sad. However, there are definitely drawbacks to consider as well with bequeathing properties via a will, which is your estate will have to go through probate. That could be time consuming, emotional, expensive. So just bear in mind, it’s not just a write it off and you’re done situation. Your loved ones will be going through it once you’re dead.

Additionally, your beneficiaries won’t have access to the properties until the probate is complete. So like I said, it can be time consuming. If you are counting on them having that revenue sooner rather than later, definitely something worth keeping in mind. Also, the probate process is public. So the value and details of your estate will be made public, which is something worth knowing before you commit to that path. And these are the things to know if you’re looking to do this through your will.

Right. Again, speaking very generally, I would love to know if you have experience with estate planning, what your plans are in the chat, but I will also tell you a little bit more about transferring rental properties to a living trust. So that’s a really popular option. It is more complicated than a will, but it also allows you to avoid probate. So your beneficiaries can access the properties more quickly and easily. It maintains your privacy because the living trust is not a public document. And it allows you to provide more specific instructions for how the properties should be managed and distributed after your death. On the flip side, like I said, it is more complicated to set up. So it’s also more expensive than setting up a regular will. And once you transfer the properties to the trust, you no longer have complete control over them, even if you haven’t died.

So that’s something to know. And the last thing we’re going to hit on here is that you have to make changes to the trust document if you want to change your plans for the properties, which can be a little bit more time intensive, not as easy as just snipping me out of the will. If we are thinking about leaving properties to me, let me know. Oh, you will get you my information.

Feel free to give me a property. Joking. But still, it is a little bit more complicated, but there are definite benefits. So weigh out with your attorney what is right for you. Once you determine what’s right for you, you’re going to want to make sure that you communicate with those involved.

Specifically, your dependence, if you are expecting there to be some kind of fee attached, maybe like an estate tax or otherwise, bombshells that they should look out for, because that is not nice to leave behind. All right. With that in mind, I’m going to take a quick pause here at the ability or team slide and see if we have anything we need to address in the chat.

Samantha Yadav:

Just a couple things. So the first, I’ve had a couple questions about locking down the screening process to avoid potential flaky tenants. So I’m going to drop a link to the webinar that we did all about screening in the chat.

So you’ve got that available to you. And then there are a few questions that are coming in specifically about legally passing your properties on and leaving your legacy in good hands this slide that we’re on. I do want to get those answered, but I think that this might be a conversation for another webinar, judging by the number of questions we’re getting. So my ask is that at the end of this webinar, we’re going to pop a survey for you, and there’s a spot in there to put in any lingering questions along with your email address. So if you have questions on this topic specifically, if you could just put those in that survey at the end, I think that we could build something really helpful for you all. Absolutely.

Krista Reuther:

Love that strategy, because it is such a broad topic. I’ve only scraped the surface, so it would make a good conversation for another webinar. With that in mind, let’s talk about your team and what we can do now. So we’ve already gone over your weaknesses, areas where you want to grow, goals that you might have, and we’ve even made mention of some of the different members who might be a part of your team to make all of this happen. Now, as you’re building out your team, of course, it’s going to be important to make sure that you have solid connections with these people, because at the end of the day, DIY, do it alone.

You don’t have to. We said it at the jump, being a successful independent landlord does not mean being an island. You are going to need help to scale up, to retire, to make sure that everything is trucking along the way that you want it to.

And there’s really no shame in asking for help. So with that in mind, I’d say make sure that you know exactly what you are looking to achieve. Those goals and barriers will change over time. But if you have them as guiding stars, well, have your goals as guiding stars. Have your barriers as things you’re working on along the way. That will help you make sure that you are continuing to move forward in a manner that is not too fast, nor too slow, right?

You’re doing things in their own time, but you have the proper assistance to help you keep going if things start to really bog you down. With that in mind, we have collected some information on the most frequently asked about team members that you might need as an independent landlord. So as so many of you mentioned in the chat, first one is going to be a contractor or a handy person.

Let’s go over the difference first. Contractors are usually skilled in a very specific area and they typically have a license. So for example, electricians, plumbers, carpenters, painters, these are all contractors. A general contractor might be the king of the contractors for a project. And they would usually have connections with other professionals who could then come in and do the additional work.

But they’re serving more as like project management and maybe whatever their specific skill set is versus going around to do all of these various jobs themselves. A handy person, on the other hand, is going to tackle simpler jobs for a lower price and they generally work alone. So if you have someone coming in because there are a couple doorknobs loose and maybe there’s a ceiling fixture that your tenant can’t reach because it’s 10 feet high, lucky them vaulted ceilings, and you need someone to go and change out a light bulb, you would hire a handy person. If you need someone to come in and rewire that light bulb, you would probably want a electrician. So if you’re not sure what you need or who you need, you’re really going to want to make sure that you reach out and you do research.

So consider the scale of your project, how much you’re looking to spend, and then reach out to your local licensing office or your state’s Department of Labor and ask if the work you need done needs a specific license. They should be able to tell you who you need. They might even have directories for you to use and call up folks to start the process of finding your person.

All right, when it comes to finding your person, there are quite a few steps you want to take, and by quite a few, I mean what is this, five, five. So first and foremost, if you do require a specific license, again, grab a list from your local government, they should be able to tell you who has that licensure and you can start doing your research. You should also ask for recommendations. So that can be in your local landlord group. That could be other landlords that you know personally.

That could be your coworker. Anybody who’s had work done similar to what you’re having done might be able to pass you a name or two that you could then research. In the course of your research, you should be looking up Google reviews, Better Business Bureau ratings, anything you can, and then start scheduling interviews. You want to actually have a conversation with them and make sure that you are collecting project quotes and scopes of work. It’s rare that someone can just give you a raw quote without seeing your property or without seeing the job, so they may need to come to the property to really fully scope it out.

That’s okay. That’s actually a good sign because then they’re not just pulling a number out of their hat and saying, well, I guess it’s $300 and then later it changes to $700. Once you go through, you’ve gotten their quotes, their scopes of work, you’ve vetted them as much as possible.

Don’t be afraid to ask for testimonials. You can then go ahead and hire the candidate who best fits your project. We recommend, and as does Lifehacker, that you put language in your agreement that says they are hired on the contingency, that they stick to their plan, timeline, and estimate, and don’t make any changes without your authorization.

It’s good legally to have in the mix. It helps to cover you if the project really goes awry, and it sets the expectation that you will be in good communication with this person as they fix whatever needs fixing. If you are looking to do a huge project, let’s say you really want to overhaul a property, I would recommend having the contractor start with something smaller first so you can evaluate their work and then moving them on to the bigger project. Hopefully you will have someone that you can get in and just continually rely on and give them a steady flow of business, which means that they are loyal to you and you have a good back and forth and an understanding about how they fit into your plans.

Samantha Yadav:

Veronica left a good tip in the chat as well. If you are hiring a licensed pro, you should look in their permits to make sure the work passed inspection before finalizing their payments. Also, as it relates to permits, typically general contractors and GCs can pull permits, but typically subcontractors cannot. Keep that in mind when you are doing renovations and big projects and things of that nature. Checking in on permits, 10 out of 10 tip there.

Krista Reuther:

Love that. Thank you so much for Annika and Samantha. Okay. Next person you want to make sure you have on your team is a real estate attorney. Also, an estate attorney, if you are looking to build your legacy, these tips can really apply to both, but a real estate attorney is usually only needed under specific circumstances. So, for example, maybe you are going through your first eviction. Sorry to hear that. Or you have a tenant who is fighting eviction and they have a lawyer. Maybe the tenant is your employee and you are firing them. Maybe the tenant is filing for bankruptcy or you are trying to comply with rent control or housing program rules for eviction. Or maybe you are trying to undergo an owner financing deal, right, where you are not financing through a bank but through the actual seller.

Perhaps you are even the seller. All of these different circumstances are going to be better off if you hire a lawyer. This is one of those areas where asking for help is highly encouraged because the law is complex. So, having someone on your side who can really walk you through and make sure that you are not making any major faux pas would be very costly is critical. Okay.

When it comes to hiring a real estate attorney, you are going to be able to find your legal eagle in a few steps. You will recognize some of these. One is asking for recommendations.

So, again, you can go to your friends and family. You can go to your landlord group. Another one specifically is your local bar association. They should be able to give you information about who has passed the bar in a specific specialty and point you in the right direction. Be sure that you are looking for someone with an area of expertise that aligns with the type of real estate transaction you are involved with. It sounds like that is an obvious point, but it really needs to be stated because if you find someone who is, like, adjacently an expert, that could really not pan out the way that you want it to.

So, find someone who aligns with what you need. Make sure that they are make sure that they are licensed to practice law in your state. Again, you can check with your state’s bar association to verify an attorney’s license status if you need. You will also want to make sure that you are asking about the attorney’s fees and costs up front. Sometimes attorneys charge an hourly rate. Others charge a flat fee, but you want to understand what you are responsible for before you hire them. And perhaps most important, choose someone you feel comfortable communicating with.

You have to be able to openly and honestly discuss your legal needs with an attorney. If you find that your communication styles don’t jive, it’s not going to be a good match. You are not going to get everything out of it that you should. Also, important for those of you looking to either get to a certain financial spot, maybe you want to earn your first million dollars, or maybe you want to expand your portfolio, these folks are going to be able to help you draw roadmap to that end goal really cleanly. Okay, because let’s face it, as a landlord, you have unique financial needs. So, with that in mind, you need someone who has experience with advising landlords specifically.

Keep that at the forefront as we move through the instructions on how to find this person. And, of course, this is not an exhaustive list, but this should give you an idea if it’s going to be a good fit for you. So, ask them how long they’ve been working as whatever role that they do, right, whether that’s a VA, a virtual assistant, a financial planner, etc. You’ll also want to ask what types of clients they usually work with.

And if they have specific experience working with landlords, people with experience working with landlords, especially if that is their specialty, should rise to the top of your list because there are just some nuances about this position that outsiders don’t know as well. And that means that there’s a learning curve. So, if you can eliminate that learning curve because you hire someone who already has experience, it’s all the more streamlined.

Additionally, make sure you understand their approach to the work that’s being undertaken. That gives you a chance to see if it aligns. Maybe they really like to fly solo and they don’t want any input from you until the job is done. That’s probably not going to work out for you if you like to be like my dad and standing over someone’s shoulder and making sure that they’re using the right screws. You know, it’s just different strokes for different folks, but have that conversation before you hire them. And, of course, on the financial side, you want to make sure that you understand what you’re going to be charged and when those payments will be due. If there is licensure required, ask that they have it just to do your due diligence. And lastly, communicate about communication.

Make sure you know how they prefer to share notifications or updates on a project and that they understand when you’re available and you understand when they’re available. All right. If you’re like, Krista, I don’t want to hire anyone. I just want this to be better for free. Listen, I feel you. I feel you 10,000%. And luckily, I can offer you a little bit of help because what holds people back often is the day-to-day drudgery of being a landlord. So when you’re bogged down and chasing late-rate rent payments, you don’t have the bandwidth to necessarily grow your portfolio.

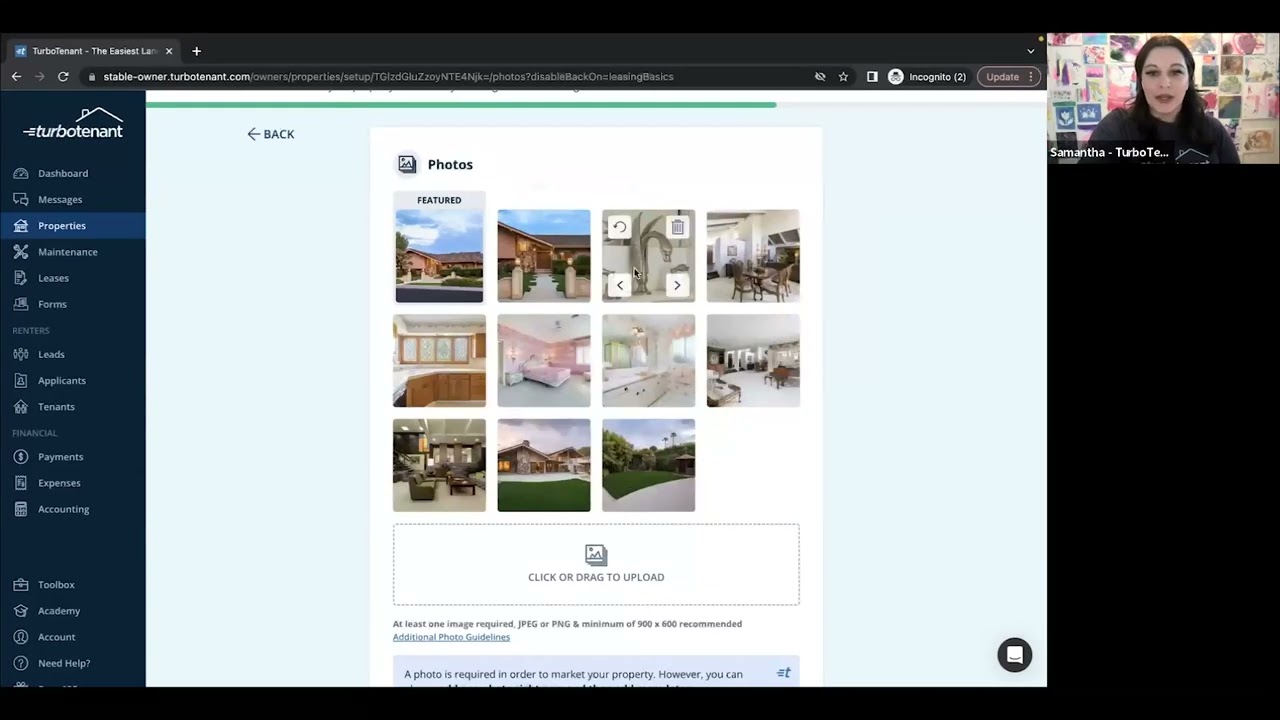

That’s why it’s really important to make sure that you are leveraging technology to streamline your processes as much as possible. If I may just throw a hat in the ring, you’re going to want to use a software that gives you free reign of a free account for as long as you need it before you have to make a purchase. Where could you do that? Well, TurboTenant.com. I know, I know, it’s sales-y, but I have to do it because it is a free resource that you guys can use. And a lot of the suggestions, excuse me, a lot of the options that you selected for processes that you don’t have, we can help you with specifically. If we take a look at our list, everything that’s highlighted here are things that we can actively do for you at TurboTenant, or at least help you do, right? So for example, we have AI-generated listing descriptions that you can utilize in a click and have your property be described beautifully without having to write very much at all.

If you don’t get paid to write like I do, it might not be your favorite thing. Why not let AI do it for you? We can also help you research rent in your neighborhood with our rent estimator report. Heck, we can take your listing and post it across the most popular websites in the game so that you get in front of as many potential tenants as possible and find the best one for you. When it comes to screening tenants, you know we do that too. We have rental applications. We can run screening reports that are comprehensive and free for landlords. You can create state-specific leases with us.

You can collect tenant signatures on those state-specific leases and move in costs on one handy platform. Oh, and did you know also that we can make sure that you’re accessible for maintenance issues? And not only that, but your tenants can reach out for emergency situations or for those general property questions all through TurboTenant.

They can send you a message. You can get it on the go, answer wherever you are, and go about your day finding your next investment property. You can also collect rent with us, and we will track down the late payments on your behalf by sending late fees and reminders. This also gives you that time-stamped record of charges and payments that we were discussing and how important that is. Oh, also, we make it possible for you to have a better relationship with your tenants. How do we do that?

Well, if you are collecting rent payments through us, not only do you get the convenience of being paid online, but we send out a little check-in every month after the tenant has made the payment to basically just have them let us know how they’re doing. Samantha, anything you’d like to add on that note? I know it’s a passion of yours.

Samantha Yadav:

Yeah, so the check-in is it’s so good. A lot of times, especially first-time renters, don’t necessarily think like as soon as they see a problem to say to you that they have a problem. So that check-in is a great way for us to be like, hey, buddy, hey, is there anything happening in your rental that your landlord should know about? And it’s super casual, but they can also put in any notes they need there. And if they want to just give you a little smiley face, everything is good, then that’s bueno. We love to see it.

Krista Reuther:

Love it so much. It helps to catch things before they become big issues. And again, any kind of personal touch back and forth with your tenant is going to be good for your relationship in the long run. Lastly here, well, not lastly, but last on this slide, of course, we have a documentation storage system so that you can keep all of your most important docs in one place. That’s good for a variety of reasons, but if in a worst case scenario you have an eviction going on, you will find that being able to have all of your documents in one source saves you so much stress. And that is going to be critical. So document, have good processes. We can help you with both.

And that’s not all. We can also help you track expenses so you can capture receipts and store them in our document storage. You can input your charges and payments and of course, monitor your NOI.

These are all critical things. You can do them for free. Sign up if you would like. I’ll make it really easy for you because you can just scan this screen. Of course, we have our mobile app.

So on the left, if you scan that, you’ll be taken to the mobile app page to download that app. It is free. You can also go ahead and create a free account on the browser if you’d like to pretend it.com. If you already have a free account and you want to take it even further, we do offer premium. So that allows you to have unlimited state-specific lease agreements, faster rent payouts, and 32 landlord forms. Quite the bargain. Thank you for indulging me in my spiel. I know we’re over time, but are there any questions that we should tackle in the chat? Yeah.

Samantha Yadav:

So just a couple quick things. The first is that the TurboTenant, most of the features are free and then that premium plan is $99 for the year and that unlocks all of the things.

All of the things. I did drop a link to our YouTube onboarding course where I walk through all the features of TurboTenant so you can actually see and feel what it looks like for you as the landlord and take a peek into the tenant side of things as well if you’d like to do that. If you submitted a request to the Facebook group and I declined it, it’s because you didn’t accept the group rules. So all you have to do is accept the group rules and we can get you in there so you can start hanging out and being a better landlord.

Love it. And don’t forget that we have a survey at the very end when we end this webinar. So if you have any follow-up questions, plug those in there with your email address so that we can get you the resources and help that you need.

Krista Reuther:

Absolutely. If we have time for one or two process questions, I’m happy to take them if we don’t or we need to have a whole new webinar. Anything we could do to help out. Yeah.

Samantha Yadav:

So somebody was asking about the rent estimate tool. That is free. When you are creating your listing, we’re going to automatically prompt you to run the tool when you’re creating that listing or it is in our toolbox so you can use it any time. We’ll email you the report and it will also be on the screen for you. Let’s see here.

I just saw something. TurboTenant automated many of my processes. Rent collection, lease, e-doc signing, maintenance tickets are awesome.

My tenants find it very easy to use. Huzzah. Great job.

Thank you, Aisha. Somebody asked about how does TurboTenant expense tracking differ from REI Hub? So the expense tracking is a free feature built into TurboTenant and it’s all manual on your end. You plug in what expenses you are monitoring and tracking.

You code them and categorize them the way that makes sense for your business. REI Hub is going to be a more robust accounting feature that you pay for that is going to automatically track things like the rental income. If you’re collecting rent through TurboTenant, it pulls those transactions in. You can also link your business accounts so that it will automatically record things like your expenses and categorize them correctly. And the best part is that unlike QuickBooks, REI Hub is built for landlords and real estate investors. So it is specific to you and to us to help streamline that process and help you with your financials. Beautiful.

Krista Reuther:

I think that’s a great note to end on. Samantha, you’ve been lovely. Jonathan, thank you for all of your help. And audience, I really appreciate you being here. I hope you have a wonderful afternoon and we will see you next time. Bye. Bye.

Top questions asked by the audience:

When dealing with big projects, should I hire a licensed professional to ensure work passes inspection before finalizing payments?

Yes, when hiring a licensed professional, it’s crucial to check that their work has passed inspection before finalizing payments. This step ensures that all renovations and projects meet the necessary standards and regulations.

How does TurboTenant's expense tracking differ from REI Hub?

TurboTenant’s expense tracking is a free feature that requires manual entry of expenses, which the landlord categorizes according to their needs. REI Hub offers a more robust solution that automatically tracks rental income and expenses, linking directly to business accounts and providing detailed financial management tailored specifically for landlords and real estate investors.