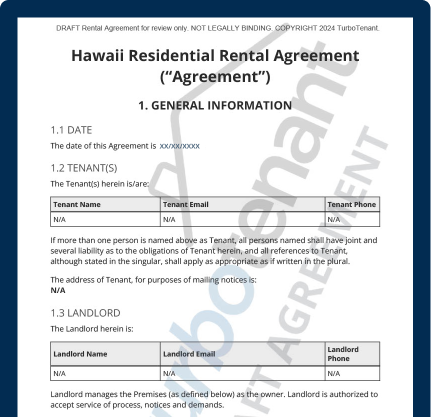

Hawaii Residential Lease Agreement

A Hawaii lease agreement details a rental contract between a tenant and landlord that shows the tenant will pay the landlord a set sum each month to allow them to live at a specific property.

Lease agreements cover a wide variety of information, including:

- Tenant and landlord information

- Lease term

- Security deposit return procedures

- Lease renewal options

- Tenant and landlord responsibilities

The landlord will send the tenant a copy of the lease to be signed. Once the document and accompanying disclosures are signed, the agreement takes effect.

Use our Hawaii residential lease agreement builder to create your custom contract in less than 15 minutes.

Hawaii Lease Agreement

Current PageTurboTenant's Hawaii lease agreement forms the backbone of a solid landlord-tenant relationship.

Hawaii Landlord-Tenant Law: Overview of Rights 2024

Learn MoreInterested in Hawaii landlord-tenant law? We cover lease agreements, evictions, tenant rights and more in this article.

Hawaii Landlord-Tenant Law

When a landlord creates a lease agreement in Hawaii, they must follow Hawaii landlord-tenant laws. The process can feel overwhelming, even for the most seasoned investment property owners and landlords, because the laws differ between states and often cities.

The challenge becomes even greater if you own properties in multiple cities or states.

Fortunately, you’re not in this alone. Our Hawaii lease agreement template is current with all Hawaii landlord-tenant laws. All you have to do is fill in the blanks.

Required Landlord Disclosures (4)

Every state has disclosures that must be signed during the leasing process.

Here are the disclosures required in Hawaii:

- Lead Paint: Federal law requires landlords to alert tenants if a property constructed before 1978 has any lead-based paint or lead-based paint hazards.

- Landlord and Designated On-Island Agent Information: If the landlord does not live on the island, the landlord must provide the name and address of the designated on-island agent appointed to manage or maintain the property (§521-43(f)).

- Excise Tax Number: The tenant shall be given the landlord’s excise tax number to take the necessary steps toward getting a low-income tax credit if applicable (§521-43(h)).

- Move-In Report: The landlord must give the tenant a report detailing the property’s condition before the tenant signs a rental contract (§ 521-42(6)).

Security Deposit Regulations

Maximum Security Deposit Amount: A month’s rent is the most a Hawaii landlord can charge for a security deposit. If a tenant owns a pet, the landlord has the right to charge an additional pet deposit (§ 521-44(b)).

Receipt of Deposit: Landlords are not required to provide tenants with a security deposit receipt in Hawaii.

Deduction Tracking: Hawaii landlords must give the tenant a written list of deductions from the security deposit, including invoices, within 14 days of the tenant’s final day living at the rental property (§ 521-44(b)(2)).

Returning a Tenant’s Security Deposit: A landlord must return a security deposit to a tenant in Hawaii within 14 days from the last day of the tenancy (§ 521-44(b)(2)).

Landlord’s Access to Property

Advance Notice: Tenants are entitled to two days’ notice before a landlord can access the unit (§ 521-53(b)).

Immediate Access: A landlord does not have to give notice to enter in an emergency, and notifying the tenant beforehand is not an option (§ 521-53(b)).

Landlord Harassment: Landlords are bound by the law not to harass tenants by entering the unit too early or late in the day. In that vein, they must provide enough notice to enter, except in emergencies. Not giving enough notice before entry can give tenants sufficient reason to break a lease early (§ 521-53(b)).

Rent Payment Laws

Grace Period: In Hawaii, tenants do not have extra time to pay after rent is due, as there is no grace period (§ 521-68(a)).

Late Rent Fees: Landlords can charge a late fee if desired, but it’s not required. The late fee should not exceed 8% of a month’s rent and must be specified in the lease (§521-21(f)).

Tenant’s Right to Withhold Rent: Tenants have the right to withhold up to one month’s rent for repairs if the landlord doesn’t handle critical repairs deemed essential for livability in the five days following the tenant alerting them to the need for a repair. To withhold rent, the tenant should get an estimate from two companies, select the more affordable option, and commence the repair work. They must keep track of all expenses, receipts, and invoices so they can relay them to the landlord (§ 521-64(b)(2)).

Breach of Rental Agreement

Missed Rent Payment: Since Hawaii does not have a grace period for rent, a landlord can give the tenant a 5-day notice to end the lease agreement (§ 521-68(a)).

Lease Violation: A Hawaii landlord should first give the tenant written notice about their violation, letting them know they have 10 days to make amends. Otherwise, the rental agreement will terminate after that period (§521-72(a)).

Self-Help Evictions: Hawaii does not allow self-help evictions. Landlords must go through the legal eviction process (§ 521-63).

Lease Abandonment: If a Hawaii tenant ends a lease early, they could be responsible for the rent for the duration of the lease and, in some cases, all amounts paid to the landlord, including an entire month’s rent (§521-70(2)).

Ending a Lease

Month-to-Month: In Hawaii, a landlord must give 45 days’ notice to end a month-to-month lease, while tenants must give 28 days’ notice (§521-71).

Fixed-Term: Domestic violence and military service are instances where a Hawaii tenant can break a fixed-term lease early (§521-80, §521-83).

Property Abandonment: A landlord has the right to sell, store (on the tenant’s dime), or donate items a tenant has left behind. They have to try to contact the tenant beforehand. If the landlord successfully sells the tenant’s personal property, the amount made from the sale should subtract storage and advertising costs, if applicable, and go into a trust for 30 days. If the tenant has not collected their items by then, the landlord retains the money made from the items (§521-56(a)(b)).

Renewing a Lease

Required Renewals: Hawaii landlords are not required to renew tenant leases.

Required Notice: Hawaii landlords must give the tenant 45 days’ notice when ending a month-to-month lease. If the tenant chooses to terminate a month-to-month lease, they only have to give 28 days’ notice. If the tenant does not have a month-to-month agreement, 10 days’ notice must be provided to end a lease, which applies to both parties. If there is a fixed-term lease of 12 months or greater, the lease will end on the final day of the rental term unless the landlord and tenant have agreed to renew the lease automatically, converting the lease to month-to-month, which is not required in Hawaii (§521-71).

Rent Control & Stabilization

Rent control and stabilization do not exist in Hawaii.

Hawaii Lease Agreement FAQs

Does a landlord have to provide a copy of the lease in Hawaii?

If there is a written agreement, a landlord must give the tenant a copy of the lease (§521-43(2)).

What is the grace period for rent in Hawaii?

Hawaii landlords are not required to institute a grace period for rent (§ 521-68(a)).

Can a landlord refuse to renew a lease in Hawaii?

Yes, landlords can refuse to renew a lease in Hawaii (§521-71).

Does a Hawaii lease need to be notarized?

A Hawaii lease does not need to be notarized.

Can you withhold rent for repairs in Hawaii?

Tenants can withhold up to one month’s rent for repairs if certain conditions are met (§ 521-64(b)(2)).