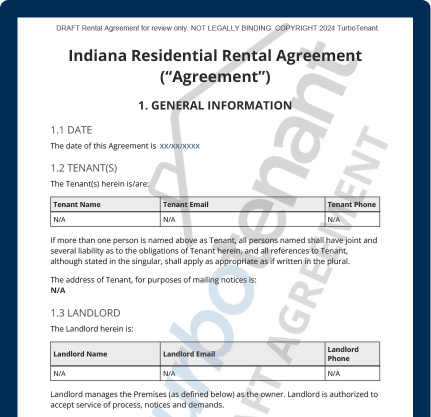

Indiana Residential Lease Agreement

An Indiana lease agreement details the terms and conditions of a rental contract so landlords and tenants understand their rights and responsibilities. Lease agreements typically contain crucial information such as the involved parties’ names and addresses, the amount of rent owed and when, information regarding utility payments, and more.

Essentially, lease agreements in Indiana ensure that all parties uphold their part of the landlord-tenant relationship, preventing future disagreements. Read on to learn how TurboTenant’s Indiana residential lease agreement can help you craft a legally binding contract to protect you and your tenants.

Indiana Lease Agreement

Current PageTurboTenant's Indiana lease agreement forms the backbone of a solid landlord-tenant relationship.

Squatters Rights in Indiana & Adverse Possession Laws 2024

Learn MoreThe laws surrounding squatters rights in Indiana are murky. We clarify them here.

Indiana Landlord-Tenant Law

Landlord-tenant law varies in critical aspects from one state to the next. For instance, regulations in Indiana require landlords to return tenants’ security deposits within 45 days of the tenant moving out, and tenants do not get a grace period for late rent payments.

These are just some of the laws that govern the landlord-tenant relationship in Indiana, and landlords must consider these rules when constructing a lease in the state. With a thorough understanding of Indiana landlord-tenant law, landlords may avoid violating state laws in their leases, leading to legal and financial penalties.

Use TurboTenant’s Indiana lease agreement builder to create a legally binding rental contract in accordance with all of the state’s laws. You can easily customize this document based on each property and landlord’s needs.

Required Landlord Disclosures (5)

- Lead-based paint: Per federal housing laws, landlords must disclose the known presence of lead-based paint in most dwelling units built prior to 1978 and provide tenants with a copy of the Environmental Protection Agency’s pamphlet regarding lead-based hazards (42 U.S. Code § 4852d).

- Name and address of landlord and/or agents: Leases must include the landlord and any agents authorized to enter the property and act on the landlord’s behalf—for example, property managers (IC § 32-31-3-18(a)).

- Smoke Detector: When the landlord delivers a dwelling unit to a tenant, the tenant must acknowledge, in writing, that the unit has a functioning smoke detector (IC § 32-31-5-7(a)).

- Flood Zone: If a building’s lowest floor—including a basement—is located at or below the 100-year frequency flood elevation, landlords must disclose in the lease that the property is in a flood plain (IC § 32-31-1-21).

- Water and Sewage Disposal Services: Landlords must inform tenants of any water and/or sewage disposal services provided (IC § 8-1-2-1.2).

Security Deposit Regulations

Maximum Security Deposit Amount: Indiana law does not restrict the amount that landlords may charge for a security deposit, so landlords can assess this fee as they see fit.

Receipt of Deposit: In Indiana, landlords are not required to provide tenants with a written receipt acknowledging security deposit payments.

Deduction Tracking: Landlords in Indiana may use funds from a security deposit to cover unpaid rent, utility, or sewer charges if the tenant is responsible for them and damages exceeding normal wear and tear (IC § 32-31-3-13). If landlords make deductions, they must prepare an itemized statement detailing these deductions and provide this statement to the tenant at the time of move-out (IC § 32-31-3-12).

Returning a Tenant’s Security Deposit: Landlords must provide the tenant with any unused portions of the security deposit and an itemized statement explaining any deductions made no more than 45 days after the tenant vacates the premises (IC § 32-31-3-12).

Landlord’s Access to Property

Advance Notice: Landlords must give tenants reasonable advance notice before entering a dwelling unit. However, Indiana law does not specify the exact length of the notice (IC § 32-31-5-6(g)).

Immediate Access: In an emergency, landlords may enter a dwelling unit without providing notice to the tenant (IC § 32-31-5-6(f)).

Landlord Harassment: In Indiana, landlords may not abuse the right of access, as this could constitute tenant harassment (IC § 32-31-5-6(g)). In this case, tenants may terminate the lease early without financial penalty due to a violation of their right to privacy.

Rent Payment Laws

Grace Period: Indiana law does not provide a grace period for tenants to pay rent. Rent is due in full on the date listed in the lease agreement.

Late Rent Fees: Landlord-tenant laws in Indiana do not cap late rent fees, so landlords may charge late fees in any amount they deem fit.

Tenant’s Right to Withhold Rent: Under Indiana law, tenants cannot withhold rent for any reason, including a landlord’s failure to make repairs.

Breach of Rental Agreement

Missed Rent Payment: If rent remains unpaid by the time and date agreed upon in the lease, landlords may charge a late rent fee and/or issue a 10-day notice to cure or quit (IC § 32-31-1-6).

Lease Violation: If a tenant violates any lease terms, the landlord must issue a notice to cure or quit and allow the tenant a reasonable timeframe to remedy the violation. However, the exact amount of time required is not specified (IC § 32-31-7-7).

Self-Help Evictions: Indiana landlord-tenant law prohibits self-help evictions, including lockouts, utility shutoffs, and violating the tenant’s right to privacy (IC § 32-31-5-6(c)).

Lease Abandonment: If a tenant moves out of a property without providing notice before a lease term concludes, this constitutes lease abandonment. The landlord may be entitled to continued rent payments from the tenant, damages, and legal fees. (IC § 32-31-7-7(f))

Ending a Lease

Month-to-Month: In Indiana, landlords must provide 30 days’ written notice to terminate a month-to-month lease (IC § 32-31-1-1).

Fixed-Term: To terminate a fixed-term lease without cause, landlords in Indiana must wait until the end of the lease term, at which point no notice is required to end the lease. Indiana law also does not require landlords to provide notice in the case of property waste, in which a tenant intentionally causes damage to the dwelling unit (IC § 32-31-1-8).

Property Abandonment: If a tenant leaves behind personal belongings when departing the premises, the landlord is not liable for loss or damage to the property. The landlord may obtain a court order to remove the abandoned property and deliver it to a warehouseman or a court-approved storage facility (IC § 32-31-4-2).

Renewing a Lease

Required Renewals: Indiana landlords are not required to allow tenants to renew their leases.

Required Notice: Like evictions, landlords must provide 30 days’ notice of intent not to renew a month-to-month lease (IC § 32-31-1-1). Landlords do not have to give any notice of intent not to renew a fixed-term lease (IC § 32-31-1-8).

Rent Control & Stabilization

Neither rent control nor rent stabilization exists in Indiana—in fact, IC § 32-31-1-20 prohibits landlords from regulating rent. As a result, landlords may raise rent by any amount they see fit.

However, specific parameters are in place. Landlords in Indiana may not raise rent in a way deemed retaliatory or discriminatory. They must also wait until the end of a lease term to raise rent and provide notice between 30 and 90 days in advance, depending on the type of lease in place.

Indiana Lease Agreement FAQ

Does a landlord have to provide a copy of the lease in Indiana?

No, landlords in Indiana do not have to provide a copy of the lease.

What is the grace period for rent in Indiana?

There is no grace period for late rent in Indiana.

Can a landlord refuse to renew a lease in Indiana?

Yes, landlords may legally refuse to renew a lease in Indiana.

Does an Indiana lease need to be notarized?

Indiana lease agreements do not need to be notarized.

Can you withhold rent for repairs in Indiana?

No, tenants may not withhold rent for any reason in Indiana, including a landlord’s failure to provide repairs.